Pitney Bowes 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

57

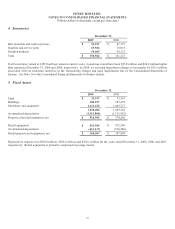

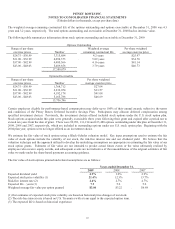

On March 4, 2008, we issued $250 million of 10 year fixed rate notes with a coupon rate of 5.60%. The interest is paid semi-annually

beginning September 2008. The notes mature on March 15, 2018. We simultaneously entered into two interest rate swaps for a total

notional amount of $250 million to convert the fixed rate debt to a floating rate obligation bearing interest at 6 month LIBOR plus

111.5 basis points. The proceeds from these notes were used for general corporate purposes, including the repayment of commercial

paper and repurchase of our stock.

We are a Well-Known Seasoned Issuer with the SEC which allows us to issue debt securities, preferred stock, preference stock,

common stock, purchase contracts, depositary shares, warrants and units.

The annual maturities of the outstanding long-term debt are as follows: 2010 – no maturities; 2011 – no maturities; 2012 – $550

million; 2013 – $375 million; 2014 – $450 million; and $2,800 million thereafter.

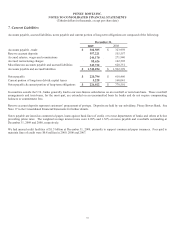

9. Income Taxes

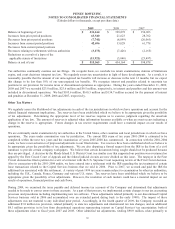

Years ended December 31,

2009 2008 2007

Continuing operations:

Total current $ 251,101 $ 142,263 $ 160,839

Total deferred (10,947) 102,666 119,383

Provision for income taxes $ 240,154 $ 244,929 $ 280,222

U.S. and international components of income from operations before income taxes are as follows:

Years ended December 31,

2009 2008 2007

Continuing operations:

U.S. $ 552,636 $ 573,066 $ 624,030

International 140,540 140,111 36,681

Total continuing operations 693,176 713,177 660,711

Discontinued operations (see Note 2) 20,624 - -

Total $ 713,800 $ 713,177 $ 660,711

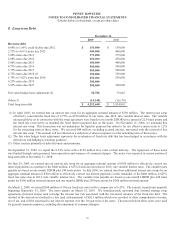

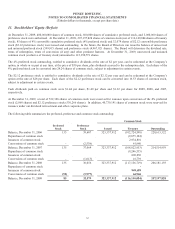

The effective tax rates for continuing operations for 2009, 2008 and 2007 were 34.6%, 34.3% and 42.4%, respectively. The effective

tax rate for 2009 included $12.9 million of tax charges related to the write-off of deferred tax assets associated with the expiration of

out-of-the-money vested stock options and the vesting of restricted stock, offset by $13.0 million of tax benefits from retirement of

inter-company obligations and the repricing of leveraged lease transactions. The effective tax rate for 2008 included $12.0 million of

tax increases related to the low tax benefit associated with restructuring expenses recorded during 2008, offset by adjustments of $9.5

million related to deferred tax assets associated with certain U.S. leasing transactions. The effective tax rate for 2007 included $54.0

million of tax charges related principally to a valuation allowance for deferred tax assets and tax rate changes outside of the U.S.