Pitney Bowes 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

61

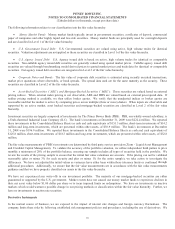

state income tax adjustments associated with the discontinued Capital Services' leasing transactions for years prior to 2007 and are

recorded as a reduction of 2007 opening retained earnings in the Consolidated Statements of Stockholders’ Equity (Deficit).

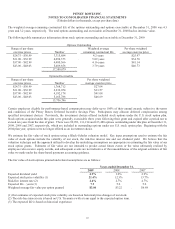

During 2009, we reversed tax benefits of $12.9 million associated with the expiration of out-of-the-money vested stock options and

the vesting of restricted stock units previously granted to our employees. During 2010, we expect to reverse tax benefits of

approximately $15 million associated with the expiration of out-of-the-money vested stock options and the vesting of restricted stock

units previously granted to our employees. These write-offs of deferred tax assets will not require the payment of any taxes.

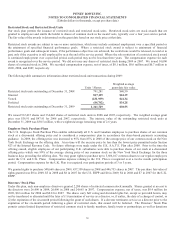

10. Noncontrolling Interests (Preferred Stockholders’ Equity in Subsidiaries)

At December 31, 2008, Pitney Bowes International Holdings, Inc. (“PBIH”), a subsidiary of the Company, had 3,750,000 shares

outstanding or $375 million of variable term voting preferred stock owned by certain outside institutional investors. These preferred

shares were entitled as a group to 25% of the combined voting power of all classes of capital stock of PBIH. All outstanding common

stock of PBIH, representing the remaining 75% of the combined voting power of all classes of capital stock, was owned directly or

indirectly by Pitney Bowes Inc. The preferred stock, $.01 par value, was entitled to cumulative dividends at rates set at auction. The

weighted average dividend rate was 4.8% for the variable term voting preferred stock during 2009 and 2008.

In October 2009, PBIH issued 300,000 shares, or $300 million, of perpetual voting preferred stock to certain outside institutional

investors. These preferred shares are entitled as a group to 25% of the combined voting power of all classes of capital stock of PBIH.

All outstanding common stock of PBIH, representing the remaining 75% of the combined voting power of all classes of capital stock,

is owned directly or indirectly by Pitney Bowes Inc. The preferred stock is entitled to cumulative dividends at a rate of 6.125% for a

period of 7 years after which it becomes callable and, if it remains outstanding, will yield a dividend that increases by 150% every six

months thereafter.

In October 2009, PBIH redeemed $344 million of its existing variable term voting preferred stock. The redemption was funded by a

combination of the issuance of the $300 million perpetual voting preferred stock and commercial paper.

In December 2009, PBIH redeemed the remaining $31 million of its existing variable term voting preferred stock. The redemption

was funded by cash flows from operations and the issuance of commercial paper.

Preferred dividends are included in Preferred stock dividends of subsidiaries attributable to noncontrolling interests in the

Consolidated Statements of Income. No dividends were in arrears at December 31, 2009 or December 31, 2008.

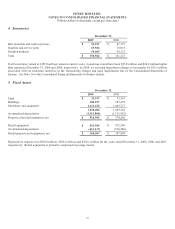

A rollforward of noncontrolling interests is as follows:

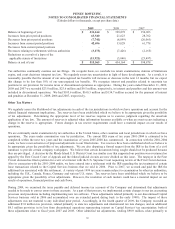

Beginning balance at January 1, 2007 and 2008 $ 384,165

Movements:

Share redemptions (1) (10,000)

Ending balance at December 31, 2008 $ 374,165

Movements:

Share issuances 296,370

Share redemptions (374,165)

Ending balance at December 31, 2009 $ 296,370

(1) At December 31, 2007, a subsidiary of the Company had 100 shares or $10 million of 9.11% Cumulative Preferred Stock,

mandatorily redeemable in 20 years, owned by an institutional investor. In August 2008, we redeemed 100% of this Preferred

Stock resulting in a net loss of $1.8 million.