Pitney Bowes 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

Dividends

It is a general practice of our Board of Directors to pay a cash dividend on common stock each quarter. In setting dividend payments,

our board considers the dividend rate in relation to our recent and projected earnings and our capital investment opportunities and

requirements. We have paid a dividend each year since 1934.

ITEM 7A. – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are exposed to the impact of interest rate changes and foreign currency fluctuations due to our investing and funding activities and

our operations denominated in different foreign currencies.

We manage our exposure to changes in interest rates by limiting its impact on earnings and cash flows and lowering our overall

borrowing costs. We use a balanced mix of debt maturities and variable and fixed rate debt together with interest rate swaps to

execute our strategy.

Our objective in managing our exposure to foreign currency fluctuations is to reduce the volatility in earnings and cash flows

associated with the effect of foreign exchange rate changes on transactions that are denominated in foreign currencies. Accordingly,

we enter into various contracts, which change in value as foreign exchange rates change, to protect the value of external and

intercompany transactions. The principal currencies actively hedged are the British pound, Canadian dollar and Euro.

We employ established policies and procedures governing the use of financial instruments to manage our exposure to such risks. We

do not enter into foreign currency or interest rate transactions for speculative purposes. The gains and losses on these contracts offset

changes in the value of the related exposures.

We utilize a “Value-at-Risk” (VaR) model to determine the potential loss in fair value from changes in market conditions. The VaR

model utilizes a “variance/co-variance” approach and assumes normal market conditions, a 95% confidence level and a one-day

holding period. The model includes all of our debt and all interest rate derivative contracts as well as our foreign exchange derivative

contracts associated with forecasted transactions. The model excludes anticipated transactions, firm commitments, and receivables

and accounts payable denominated in foreign currencies, which certain of these instruments are intended to hedge.

The VaR model is a risk analysis tool and does not purport to represent actual losses in fair value that will be incurred by us, nor does

it consider the potential effect of favorable changes in market factors.

During 2009 and 2008, our maximum potential one-day loss in fair value of our exposure to foreign exchange rates and interest rates,

using the variance/co-variance technique described above, was not material.

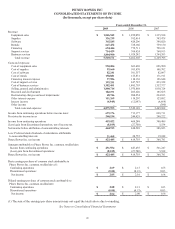

ITEM 8. – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

See “Index to Consolidated Financial Statements and Supplemental Data” on Page 38 of this Form 10-K.

ITEM 9. – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. – CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Under the direction of our Chief Executive Officer and Chief Financial Officer, we evaluated our disclosure controls and procedures

(as defined in Rule 13a-15(e) or Rule 15a-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) and

internal control over financial reporting. The CEO and CFO concluded that such disclosure controls and procedures were effective as

of December 31, 2009, based on the evaluation of these controls and procedures required by paragraph (b) of Rule 13a-15 or Rule

15d-15 under the Exchange Act. It should be noted that any system of controls is based in part upon certain assumptions designed to

obtain reasonable (and not absolute) assurance as to its effectiveness, and there can be no assurance that any design will succeed in

achieving its stated goals. Notwithstanding this caution, the CEO and CFO have reasonable assurance that the disclosure controls and

procedures were effective as of December 31, 2009.