Pitney Bowes 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

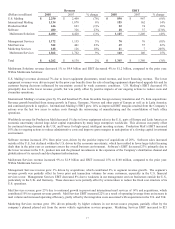

Pension benefits

Assumptions and estimates

The valuation and calculation of our net pension expense, assets and obligations are dependent on various assumptions and estimates.

We make assumptions relating to discount rate, rate of compensation increase, expected return on plan assets and other factors. These

assumptions are evaluated and updated annually and are described in further detail in Note 19 to the Consolidated Financial

Statements. The following assumptions relate to our U.S. qualified pension plan, which is our largest plan. We determine our

discount rate for the U.S. retirement benefit plan by using a model that discounts each year’s estimated benefit payments by an

applicable spot rate. These spot rates are derived from a yield curve created from a large number of high quality corporate bonds.

Accordingly, our discount rate assumption was 5.75% at December 31, 2009 and 6.05% at December 31, 2008. The rate of

compensation increase assumption reflects our actual experience and best estimate of future increases. Our estimate of the rate of

compensation increase was 3.50% at December 31, 2009 and 4.25% at December 31, 2008. Our expected return on plan assets is

based on historical and projected rates of return for current and planned asset classes in the plans’ investment portfolio after analyzing

historical experience and future expectations of the returns and volatility of the various asset classes. The overall expected rate of

return for the portfolio is determined based on the target asset allocations for each asset class, adjusted for historical and expected

experience of active portfolio management results, when compared to the benchmark returns. When assessing the expected future

returns for the portfolio, we place more emphasis on the expected future returns than historical returns. Our expected return on plan

assets assumption was 8.0% at December 31, 2009 and 2008.

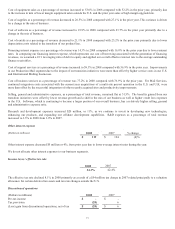

Sensitivity to changes in assumptions:

U.S. Pension Plan

xDiscount rate – a 0.25% increase in the discount rate would decrease annual pension expense by approximately $2.4 million

and would lower the projected benefit obligation by $39.2 million.

xRate of compensation increase – a 0.25% increase in the rate of compensation increase would increase annual pension

expense by approximately $0.6 million.

xExpected return on plan assets – a 0.25% increase in the expected return on assets of our principal plans would decrease

annual pension expense by approximately $3.9 million.

The following assumptions relate to our U.K. qualified pension plan, which is our largest foreign plan. We determine our discount

rate for the U.K. retirement benefit plan by using a model that discounts each year’s estimated benefit payments by an applicable spot

rate. These spot rates are derived from a yield curve created from a large number of high quality corporate bonds. Accordingly, our

discount rate assumption was 5.70% at December 31, 2009 and 6.3% at December 31, 2008. The rate of compensation increase

assumption reflects our actual experience and best estimate of future increases. Our estimate of the rate of compensation increase was

3.50% at December 31, 2009 and 4.3% at December 31, 2008. Our expected return on plan assets is determined based on historical

portfolio results, the plan’s asset mix and future expectations of market rates of return on the types of assets in the plan. Our expected

return on plan assets assumption was 7.50% and 7.25% at December 31, 2009 and 2008, respectively.

U.K. Pension Plan

xDiscount rate – a 0.25% increase in the discount rate would decrease annual pension expense by approximately $1.4 million

and would lower the projected benefit obligation by $15.4 million.

xRate of compensation increase – a 0.25% increase in the rate of compensation increase would increase annual pension

expense by approximately $0.4 million.

xExpected return on plan assets – a 0.25% increase in the expected return on assets of our principal plans would decrease

annual pension expense by approximately $0.7 million.

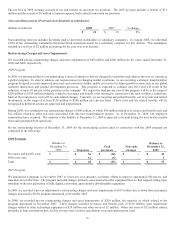

Delayed recognition principles

In accordance with the retirement benefits accounting guidance, actual pension plan results that differ from our assumptions and

estimates are accumulated and amortized over the estimated future working life of the plan participants and will therefore affect

pension expense recognized and obligations recorded in future periods. We also base our net pension expense primarily on a market

related valuation of plan assets. In accordance with this approach, we recognize differences between the actual and expected return on

plan assets primarily over a five-year period and as a result future pension expense will be impacted when these previously deferred

gains or losses are recorded.

Investment related risks and uncertainties

We invest our pension plan assets in a variety of investment securities in accordance with our strategic asset allocation policy. The

composition of our U.S. pension plan assets at December 31, 2009 was approximately 54% equity securities, 38% fixed income