Pitney Bowes 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

70

use derivatives to manage the related cost of debt and to limit the effects of foreign exchange rate fluctuations on financial results. We

do not use derivatives for trading or speculative purposes.

As required by the fair value measurements guidance, we have incorporated counterparty risk into the fair value of our derivative

assets and our credit risk into the value of our derivative liabilities. We derive credit risk from observable data related to credit default

swaps. We have not seen a material change in the creditworthiness of those banks acting as derivative counterparties.

The valuation of our interest rate swaps is based on the income approach using a model with inputs that are observable or that can be

derived from or corroborated by observable market data. Our foreign exchange derivatives are measured at fair value using

observable market inputs, such as forward rates.

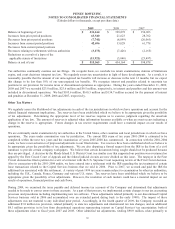

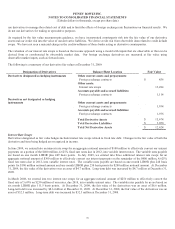

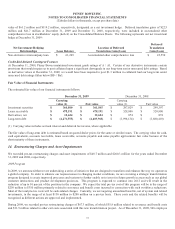

The following is a summary of our derivative fair values at December 31, 2009:

Designation of Derivatives Balance Sheet Location Fair Value

Derivatives designated as hedging instruments Other current assets and prepayments:

Foreign exchange contracts $ 456

Other assets:

Interest rate swaps 13,284

Accounts payable and accrued liabilities:

Foreign exchange contracts 1,114

Derivatives not designated as hedging

instruments Other current assets and prepayments:

Foreign exchange contracts 1,934

Accounts payable and accrued liabilities:

Foreign exchange contracts 1,936

Total Derivative Assets $ 15,674

Total Derivative Liabilities $ 3,050

Total Net Derivative Assets $ 12,624

Interest Rate Swaps

Derivatives designated as fair value hedges include interest rate swaps related to fixed rate debt. Changes in the fair value of both the

derivative and item being hedged are recognized in income.

In June 2009, we entered into an interest rate swap for an aggregate notional amount of $100 million to effectively convert our interest

payments on a portion of the $400 million, 4.625% fixed rate notes due in 2012, into variable interest rates. The variable rates payable

are based on one month LIBOR plus 249 basis points. In July 2009, we entered into three additional interest rate swaps for an

aggregate notional amount of $300 million to effectively convert our interest payments on the remainder of the $400 million, 4.625%

fixed rate notes due in 2012, into variable interest rates. The variable rates payable are based on one month LIBOR plus 248 basis

points for $100 million notional amount and one month LIBOR plus 250 basis points for $200 million notional amount. At December

31, 2009, the fair value of the derivatives was an asset of $4.7 million. Long-term debt was increased by $4.7 million at December 31,

2009.

In March 2008, we entered into two interest rate swaps for an aggregate notional amount of $250 million to effectively convert the

fixed rate of 5.60% on $250 million of our notes, due 2018, into variable interest rates. The variable rates payable by us are based on

six month LIBOR plus 111.5 basis points. At December 31, 2009, the fair value of the derivatives was an asset of $8.6 million.

Long-term debt was increased by $8.6 million at December 31, 2009. At December 31, 2008, the fair value of the derivatives was an

asset of $32.5 million. Long-term debt was increased by $32.5 million at December 31, 2008.