Pitney Bowes 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

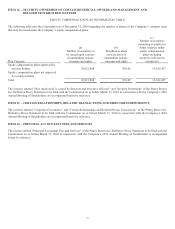

43

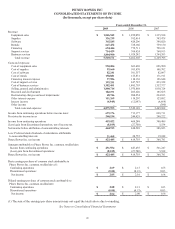

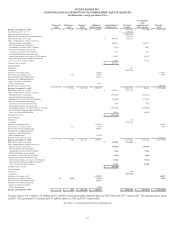

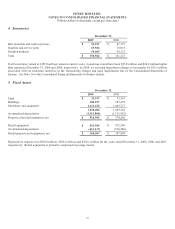

PITNEY BOWES INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT)

(In thousands, except per share data)

Preferred

stock

Preference

stock

Common

stock

Additional

paid-in capital

Comprehensive

income (loss)

Retained

earnings

Accumulated

other

comprehensive

(loss) income

Treasury

stock

Balance, December 31, 2006 $ 7 $ 1,068 $ 323,338 $ 235,558 - $ 4,156,994 $ (131,744) $ (3,869,166)

Tax adjustment (see note 9) (98,900)

Adjusted retained earnings 4,058,094

Adoption of accounting for tax uncertainties (84,363)

Pitney Bowes Inc. net income $ 366,781 366,781

Other comprehensive income, net of tax:

Foreign currency translations 164,728 164,728

Net unrealized gain on derivative

instruments, net of tax of $1.8 million 2,801 2,801

Net unrealized gain on investment

securities, net of tax of $0.0 million 352 352

Net unamortized gain on pension and

postretirement plans, net of tax of $15.9 million 30,347 30,347

Amortization of pension and postretirement

costs, net of tax of $13.3 million 22,172 22,172

Comprehensive income $ 587,181

Cash dividends:

Preference (81)

Common (288,709)

Issuances of common stock (7,967) 111,925

Conversions to common stock (65) (1,530) 1,595

Pre-tax stock-based compensation 24,131

Adjustments to additional paid in

capital, tax effect from share-

based compensation 1,993

Repurchase of common stock (399,996)

Balance, December 31, 2007 7 1,003 323,338 252,185 4,051,722 88,656 (4,155,642)

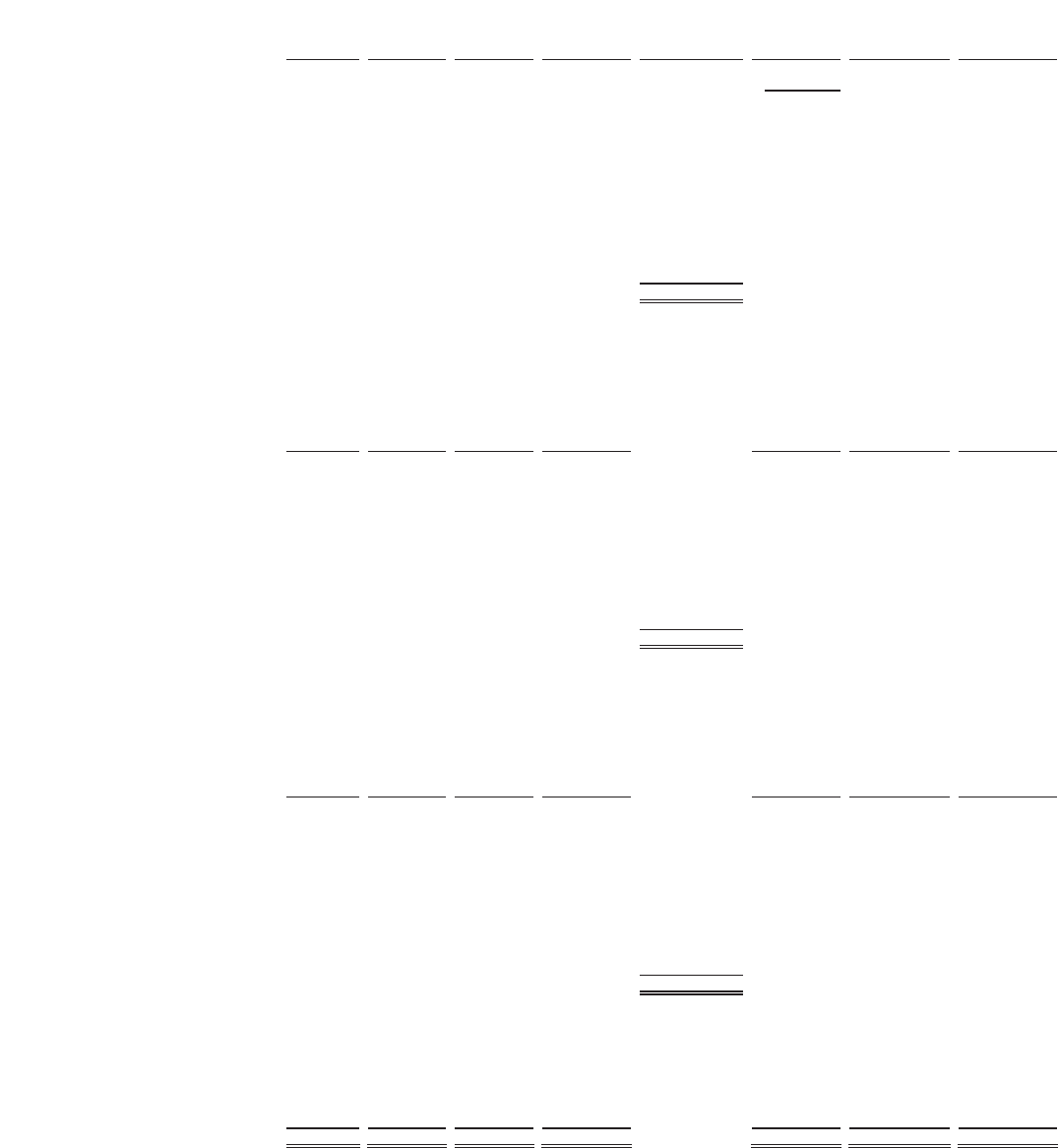

Pitney Bowes Inc. net income $ 419,793 419,793

Other comprehensive income, net of tax:

Foreign currency translations (305,452) (305,452)

Net unrealized loss on derivative

instruments, net of tax of ($12.4) million (18,670) (18,670)

Net unrealized gain on investment

securities, net of tax of $0.4 million 580 580

Net unamortized loss on pension and

postretirement plans, net of tax of ($216.1) million (375,544) (375,544)

Amortization of pension and postretirement

costs, net of tax of $8.6 million 14,089 14,089

Comprehensive loss $ (265,204)

Cash dividends:

Preference (77)

Common (291,534)

Issuances of common stock (11,573) 34,268

Conversions to common stock (27) (609) 636

Pre-tax stock-based compensation 26,402

Adjustments to additional paid in

capital, tax effect from share-

based compensation (7,099)

Repurchase of common stock (333,231)

Balance, December 31, 2008 7 976 323,338 259,306 4,179,904 (596,341) (4,453,969)

Pitney Bowes Inc. net income $ 423,445 423,445

Other comprehensive income, net of tax:

Foreign currency translations 119,820 119,820

Net unrealized gain on derivative

instruments, net of tax of $4.9 million 7,214 7,214

Net unrealized loss on investment

securities, net of tax of ($0.1) million (283) (283)

Net unamortized loss on pension and

postretirement plans, net of tax of $8.4 million (5,116) (5,116)

Amortization of pension and postretirement

costs, net of tax of $10.6 million 17,328 17,328

Comprehensive income $ 562,408

Cash dividends:

Preference (72)

Common (297,483)

Issuances of common stock (22,017) 36,419

Conversions to common stock (3) (108) (2,343) 2,454

Pre-tax stock-based compensation 21,761

Adjustments to additional paid in

capital, tax effect from share-

based compensation (574)

Balance, December 31, 2009 $ 4 $ 868 $ 323,338 $ 256,133 $ 4,305,794 $ (457,378) $ (4,415,096)

Treasury shares of 0.9 million, 0.9 million and 3.0 million were issued under employee plans in 2009, 2008 and 2007, respectively. We repurchased no shares

in 2009. We repurchased 9.2 million and 9.1 million shares in 2008 and 2007, respectively.

See Notes to Consolidated Financial Statements