Pitney Bowes 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

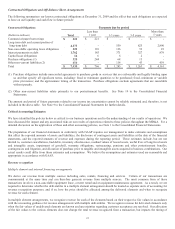

17

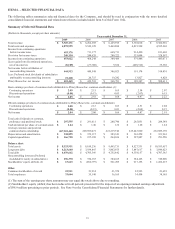

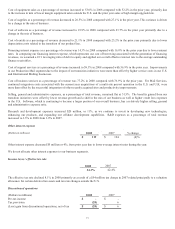

Revenue EBIT

(Dollars in millions) 2008 2007 % change 2008 2007 % change

U.S. Mailing $ 2,250 $ 2,409 (7)% $ 890 $ 967 (8)%

International Mailing 1,134 1,070 6% 185 162 14%

Production Mail 616 623 (1)% 82 74 10%

Software 400 326 23% 28 37 (23)%

Mailstream Solutions 4,400 4,428 (1)% 1,185 1,240 (4)%

Management Services 1,172 1,135 3% 70 76 (8)%

Mail Services 542 441 23% 69 57 22%

Marketing Services 148 126 18% 21 7 205%

Mailstream Services 1,862 1,702 9% 160 140 15%

Total $ 6,262 $ 6,130 2% $ 1,345 $ 1,380 (3)%

Mailstream Solutions revenue decreased 1% to $4.4 billion and EBIT decreased 4% to $1.2 billion, compared to the prior year.

Within Mailstream Solutions:

U.S. Mailing’s revenue decreased 7% due to lower equipment placements, rental revenue, and lower financing revenue. The lower

equipment revenues were driven in part by the prior year benefits from the sale of mailing equipment shape-based upgrade kits and by

customer buying decisions influenced by uncertainty created by weak economic conditions. U.S. Mailing’s EBIT decreased 8%

principally due to the lower revenue growth, but was partly offset by positive impacts of our ongoing actions to reduce costs and

streamline operations.

International Mailing’s revenue grew by 6% and benefited 2% from favorable foreign currency translation and 1% from acquisitions.

Revenue growth benefited from strong growth in France, Germany, Norway and other parts of Europe as well as in Latin America;

and continued growth in supplies. International Mailing’s EBIT grew 14% as improved EBIT margins resulted from the Company’s

actions over the last two years to reduce costs through the outsourcing of manufacturing and the consolidation of back office

operations.

Worldwide revenue for Production Mail decreased 1% due to lower equipment sales in the U.S., parts of Europe and Latin America as

economic uncertainty slowed large-ticket capital expenditures by many large enterprises worldwide. This decrease was partly offset

by continued strong demand in the U.K. and France for high-speed, intelligent inserting systems. Production Mail’s EBIT increased

10% due to ongoing actions to reduce administrative costs and improve gross margins in anticipation of a slowing capital investment

environment.

Software revenue increased 23% from prior year, driven by the positive impact of acquisitions of 20%. Software sales increased

outside of the U.S., but declined within the U.S. driven by the economic uncertainty, which has resulted in fewer large-ticket licensing

deals than in the prior year as customers assess the overall business environment. Software’s EBIT decreased 23% primarily due to

the lower revenues in the U.S., product mix and the planned investments in the expansion of the Company’s distribution channel and

globalization of its research and development infrastructure.

Mailstream Services revenue increased 9% to $1.9 billion and EBIT increased 15% to $160 million, compared to the prior year.

Within Mailstream Services:

Management Services revenue grew 3% driven by acquisitions, which contributed 6% to segment revenue growth. The segment’s

revenue growth was partially offset by lower print and transaction volumes for some customers, especially in the U.S. financial

services sector. Management Services EBIT decreased 8% due to weakness in our management services businesses outside the U.S.,

particularly in the U.K. and Germany. These decreases were partially offset by actions taken to reduce the fixed cost structure of its

U.S. operations.

Mail Services revenue grew 23% due to continued growth in presort and international mail services of 14% and acquisitions, which

contributed 10% to segment revenue growth. Mail Services EBIT increased 22% as a result of operating leverage from an increase in

mail volume and increased operating efficiency, partly offset by the integration costs associated with acquisitions in the U.S. and U.K.

Marketing Services revenue grew 18% driven primarily by higher volumes in our mover-source program, partially offset by the

company’s planned phased exit from the motor vehicle registration services program. Marketing Services EBIT increased to $21