Pitney Bowes 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

71

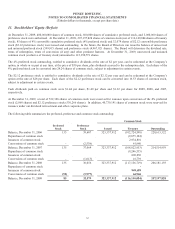

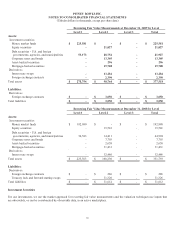

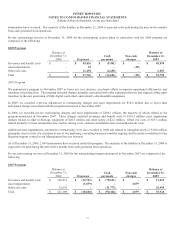

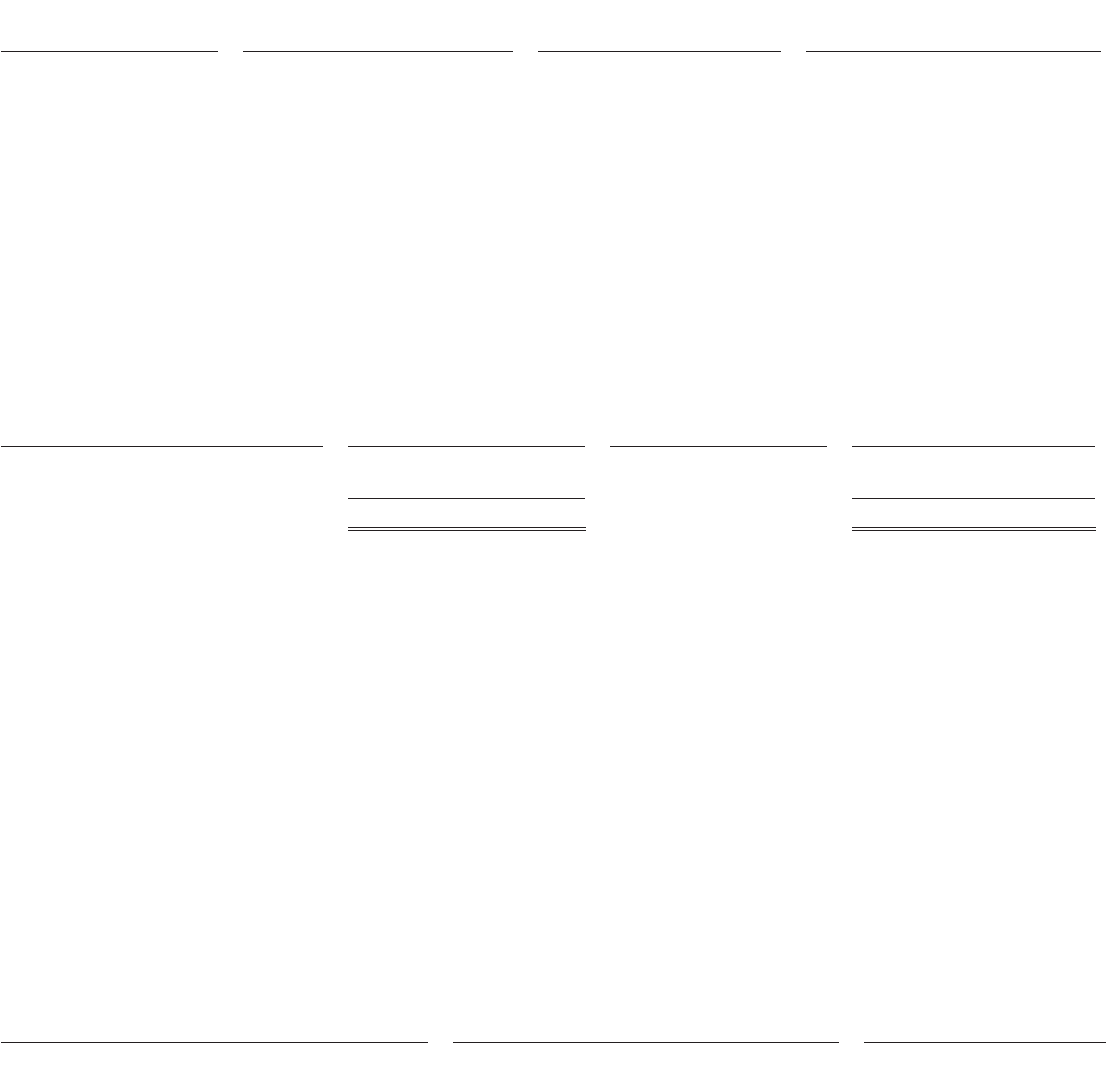

The following represents the results of our derivatives in fair value hedging relationships for the twelve months ended December 31,

2009:

Derivative Instrument

Location of Gain (Loss)

Recognized in Income

Derivative Gain (Loss)

Recognized in Income

Hedged Item Income (Expense)

Recognized in Income

Interest rate swaps Interest expense $ 12,180 $ (23,250)

Foreign Exchange Contracts

We enter into foreign currency exchange contracts arising from the anticipated purchase of inventory between affiliates. These

contracts are designated as cash flow hedges. The effective portion of the gain or loss on the cash flow hedges is included in other

comprehensive income in the period that the change in fair value occurs and is reclassified to income in the same period that the

hedged item is recorded in income. At December 31, 2009, we had 149 outstanding contracts with a notional amount of $27.8 million

associated with these anticipated transactions and a derivative net liability position of $0.7 million. We had no outstanding contracts

at December 31, 2008.

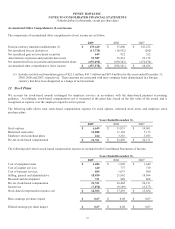

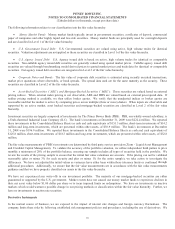

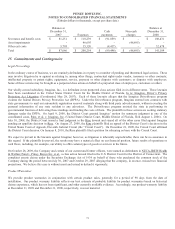

The following represents the results of cash flow hedging relationships for the twelve months ended December 31, 2009:

Derivative Instrument

Derivative Gain (Loss)

Recognized in OCI

(Effective Portion) (1)

Location of Derivative

Gain (Loss)

Reclassified from

AOCI into Income

(Effective Portion)

Gain (Loss) Reclassified

from AOCI to Income

(Effective Portion)

Foreign exchange contracts $ 290 Revenue $ -

Foreign exchange contracts (948) Cost of sales -

$ (658) $ -

(1) At December 31, 2008, there were no outstanding cash flow hedges and, therefore, the opening AOCI balance related to

these types of hedges was $0. For the twelve months ended December 31, 2009, there were 82 derivatives that were

entered into and settled during the year. For the twelve months ended December 31, 2009, these derivatives reduced

revenue in the amount of $0.3 million and increased cost of sales in the amount of $1.7 million.

As of December 31, 2009, $0.3 million of the $0.7 million derivative loss recognized in OCI will be recognized in income

within the next 12 months.

No amount of ineffectiveness was recorded in the Consolidated Statements of Income for these designated cash flow

hedges.

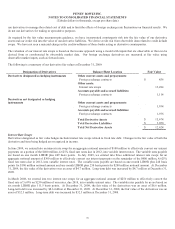

We also enter into foreign exchange contracts to minimize the impact of exchange rate fluctuations on intercompany loans and related

interest that are denominated in a foreign currency. The revaluation of the short-term intercompany loans and interest and the mark-

to-market on the derivatives are both recorded to income. At December 31, 2009, we had 21 outstanding foreign exchange contracts

to buy or sell various currencies with a net liability value of less than $0.1 million. The contracts will expire by May 10, 2010. At

December 31, 2008, the liability value of these derivatives was $0.3 million.

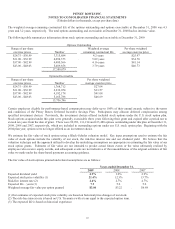

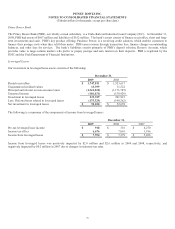

The following represents the results of our non-designated derivative instruments for the twelve months ended December 31, 2009:

Derivatives Not Designated

as Hedging Instruments Location of Derivative Gain (Loss)

Derivative Gain (Loss)

Recognized in Income

Foreign exchange contracts Selling, general and administrative expense $ (861)

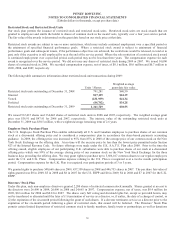

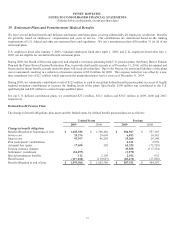

Net Investment Hedges

One of our intercompany loans denominated in a foreign currency is designated as a hedge of a net investment. The revaluation of

this loan is reflected as a deferred translation gain or loss and thereby offsets a portion of the translation adjustment of the applicable

foreign subsidiaries’ net assets. At December 31, 2009 and December 31, 2008, we had one intercompany loan with an outstanding