Pitney Bowes 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

89

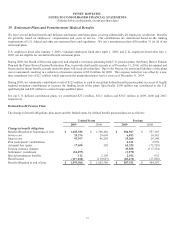

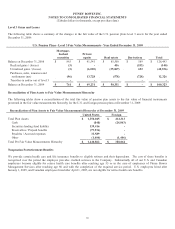

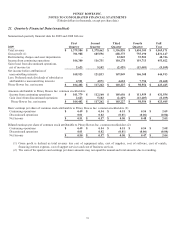

The change in benefit obligations, plan assets and the funded status for nonpension postretirement benefit plans are as follows:

December 31,

2009 2008

Change in benefit obligation:

Benefit obligations at beginning of year $ 244,544 $ 246,572

Service cost 3,424 3,613

Interest cost 14,437 14,410

Plan participants’ contributions 8,778 8,627

Actuarial loss (gain) 21,489 14,662

Foreign currency changes 2,509 (3,653)

Gross benefits paid (43,494) (42,259)

Less federal subsidy on benefits paid 2,718 2,572

Benefit obligations at end of year $ 254,405 $ 244,544

Change in plan assets:

Fair value of plan assets at beginning of year $ - $ -

Company contribution 31,998 31,060

Plan participants’ contributions 8,778 8,627

Gross benefits paid (43,494) (42,259)

Less federal subsidy on benefits paid 2,718 2,572

Fair value of plan assets at end of year $ - $ -

Funded status, end of year:

Fair value of plan assets at end of year $ - $ -

Benefit obligations at end of year 254,405 244,544

Funded status $ (254,405) $ (244,544)

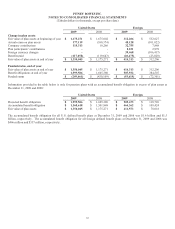

The discount rates used in determining the accumulated postretirement benefit obligations for the U.S. plan were 5.35% in 2009 and

5.95% in 2008. The discount rates used in determining the accumulated postretirement benefit obligations for the Canadian plan were

5.85% in 2009 and 6.60% in 2008.

Amounts recognized in the Consolidated

Balance Sheets consist of: 2009 2008

Current liability $ (26,293) $ (26,920)

Non-current liability (228,112) (217,624)

Net amount recognized $ (254,405) $ (244,544)

Pre-tax amounts recognized in AOCI consist of:

Net actuarial loss $ 74,044 $ 55,764

Prior service credit (8,397) (10,872)

Total $ 65,647 $ 44,892

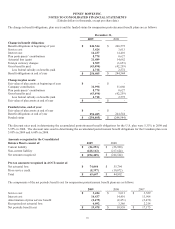

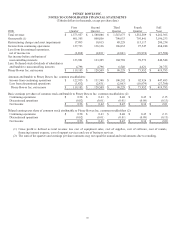

The components of the net periodic benefit cost for nonpension postretirement benefit plans are as follows:

2009 2008 2007

Service cost $ 3,424 $ 3,613 $ 3,529

Interest cost 14,437 14,410 13,904

Amortization of prior service benefit (2,475) (2,471) (2,472)

Recognized net actuarial loss 4,092 3,386 2,214

Net periodic benefit cost $ 19,478 $ 18,938 $ 17,175