Pitney Bowes 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

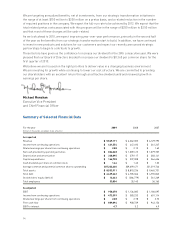

We are targeting annualized benefits, net of investments, from our strategic transformation initiatives in

the range of at least $150 million to $200 million on a pretax basis, and a related reduction in the number

of required positions in the company. We expect the full-run rate to be achieved by 2012. We expect that the

total related pretax costs associated with this program will be in the range of $250 million to $350 million

and that most of these charges will be cash-related.

As we look ahead to 2010, we expect improving year-over-year performance, primarily in the second half

of the year as the benefits from our strategic transformation start to build. In addition, we have continued

to invest in new products and solutions for our customers and expect our recently announced strategic

partnerships to begin to contribute to growth.

These factors have given us the confidence to increase our dividend for the 28th consecutive year. We were

pleased that our Board of Directors decided to increase our dividend to $0.365 per common share for the

first quarter of 2010.

We believe we are focused on the right priorities to deliver value in a changing business environment.

We are investing for growth while continuing to lower our cost structure. We are committed to providing

our shareholders with an excellent return through an attractive dividend yield and renewed growth in

earnings per share.

Michael Monahan

Executive Vice President

and Chief Financial Officer

Summary of Selected Financial Data

For the year 2009 2008 2007

(Dollars in thousands, except per share amounts)

As reported

Revenue $ 5,569,171 $ 6,262,305 $ 6,129,795

Income from continuing operations $ 431,554 $ 447,493 $ 361,247

Diluted earnings per share from continuing operations $ 2.08 $ 2.13 $ 1.63

Net cash provided by operating activities $ 824,068 $ 1,009,415 $ 1,079,707

Depreciation and amortization $ 338,895 $ 379,117 $ 383,141

Capital expenditures $ 166,728 $ 237,308 $ 264,656

Cash dividends per share of common stock $ 1.44 $ 1.40 $ 1.32

Average common and potential common shares outstanding 207,322,440 209,699,471 221,219,746

Total assets $ 8,533,911 $ 8,810,236 $ 9,465,731

Total debt $ 4,439,662 $ 4,705,366 $ 4,755,842

Stockholders’ equity (deficit) $ 13,663 $ (286,779) $ 561,269

Total employees 33,004 35,140 36,165

As adjusted

EBIT $ 950,278 $ 1,136,085 $ 1,186,097

Income from continuing operations $ 473,399 $ 583,233 $ 601,114

Diluted earnings per share from continuing operations $ 2.28 $ 2.78 $ 2.72

Free cash flow $ 889,094 $ 908,739 $ 943,156

EBIT to interest 4.7 5.2 4.9