Pitney Bowes 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

67

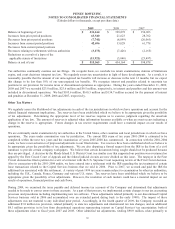

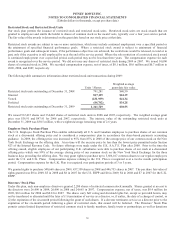

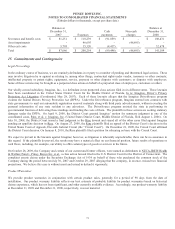

to charity after the expiration of the six-month holding period, provided the director retains a minimum of 7,500 shares of restricted

common stock.

Non-employee directors may defer up to 100% of their eligible compensation, subject to the terms and conditions of the Pitney Bowes

Deferred Incentive Savings Plan for directors. Participants may allocate deferred compensation among specified investment choices.

Previously, the investment choices offered included stock options under the Directors’ Stock Plan. Stock options acquired under this

plan were generally exercisable three years following their grant and expired after a period not to exceed ten years. There were

15,269, 15,269 and 22,091 options outstanding under this plan at December 31, 2009, 2008 and 2007, respectively. Beginning with

the 2004 plan year, options were no longer offered as an investment choice.

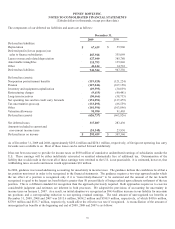

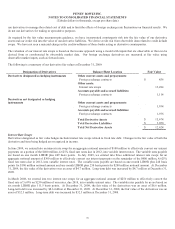

13. Fair Value Measurements

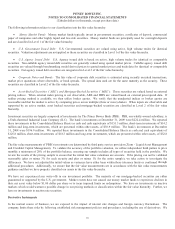

Effective January 1, 2008, we adopted the fair value measurements guidance for financial assets and liabilities. Fair value is a market-

based measure considered from the perspective of a market participant rather than an entity-specific measure. The guidance

emphasizes that an entity’s valuation technique for measuring fair value should maximize observable inputs and minimize

unobservable inputs.

Non-recurring nonfinancial assets and nonfinancial liabilities include those measured at fair value in goodwill and indefinite lived

intangible asset impairment testing, and those non-recurring nonfinancial assets and nonfinancial liabilities initially measured at fair

value in a business combination. The new fair value definition and disclosure requirements for these specific nonfinancial assets and

nonfinancial liabilities were effective January 1, 2009.

The fair value measurement guidance established a fair value hierarchy that prioritizes the inputs used to measure fair value. The

three levels of the fair value hierarchy are as follows:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities. Examples of Level 1 assets include money

market securities and U.S. Treasury securities.

Level 2 – Observable inputs other than Level 1 inputs such as quoted prices for similar assets or liabilities; quoted prices in markets

that trade infrequently; or other inputs that are observable or can be corroborated by observable market data for substantially the full

term of the assets or liabilities. Examples of Level 2 assets and liabilities include derivative contracts whose values are determined

using a model with inputs that are observable in the market or can be derived from or corroborated by observable market data, such as

mortgage-backed securities, asset backed securities, U.S. agency securities, and corporate notes and bonds.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the asset or

liability. These inputs may be derived with internally developed methodologies that result in management’s best estimate of fair

value.

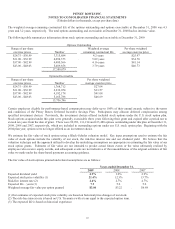

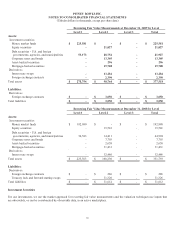

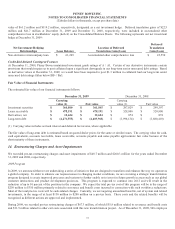

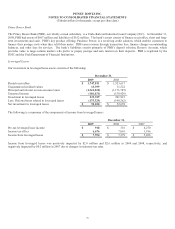

The following tables show, by level within the fair value hierarchy, our financial assets and liabilities that are accounted for at fair

value on a recurring basis at December 31, 2009 and 2008, respectively. As required by the fair value measurements guidance,

financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value

measurement. Our assessment of the significance of a particular input to the fair value measurement requires judgment and may affect

their placement within the fair value hierarchy levels.