Pitney Bowes 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

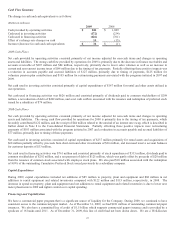

Income taxes

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. Tax reserves have been established which we believe to be appropriate given the possibility

of tax adjustments. Determining the appropriate level of tax reserves requires us to exercise judgment regarding the uncertain

application of tax law. The amount of reserves is adjusted when information becomes available or when an event occurs indicating a

change in the reserve is appropriate. Future changes in tax reserve requirements could have a material impact on our results of

operations.

We are continually under examination by tax authorities in the United States, other countries and local jurisdictions in which we have

operations. The years under examination vary by jurisdiction. The current IRS exam of tax years 2001-2004 is estimated to be

completed within the next two years and the examination of years 2005-2008 has commenced. In connection with the 2001-2004

exam, we have received notices of proposed adjustments to our filed returns. Tax reserves have been established which we believe to

be appropriate given the possibility of tax adjustments. We are also disputing a formal request from the IRS in the form of a civil

summons to provide certain company workpapers. We believe that certain documents being sought should not be produced because

they are privileged. A decision by the Rhode Island U.S. District Court in a similar case that supported our position was overturned on

appeal by the First Circuit Court of Appeals and the federal judicial circuits are now divided on this issue. The taxpayer in the First

Circuit decision has filed a petition for a writ of certiorari with the U.S. Supreme Court requesting review of the First Circuit decision.

Also in connection with the 2001-2004 audits, we have entered into a settlement with the IRS regarding the tax treatment of certain

lease transactions related to the Capital Services business that we sold in 2006. Prior to 2007, we accrued and paid the IRS the

additional tax associated with this settlement. A variety of post-1999 tax years remain subject to examination by other tax authorities,

including the U.K., Canada, France, Germany and various U.S. states. Tax reserves have been established which we believe to be

appropriate given the possibility of tax adjustments. However, the resolution of such matters could have a material impact on our

results of operations, financial position and cash flows.

During 2010, we expect to reverse tax benefits of approximately $15 million associated with the expiration of out-of-the-money

vested stock options and the vesting of restricted stock units previously granted to our employees. These write-offs of deferred tax

assets will not require the payment of any taxes.

Effects of Inflation and Foreign Exchange

Inflation, although minimal in recent years, continues to affect worldwide economies and the way companies operate. It increases

labor costs and operating expenses, and raises costs associated with replacement of fixed assets such as rental equipment. Despite

these growing costs, we have generally been able to maintain profit margins through productivity and efficiency improvements,

continual review of both manufacturing capacity and operating expense levels, and, where applicable, price increases.

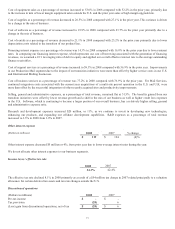

Currency translation decreased our 2009 revenue by approximately 2%. Also, currency translation losses decreased our income

before taxes by $13 million. Based on the current contribution from our international operations, a 1% increase in the value of the

U.S. dollar would result in a decline in revenue of approximately $16 million and a decline in income from continuing operations

before income taxes of approximately $2 million.

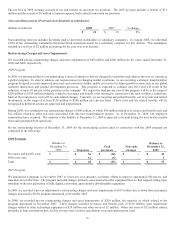

Although not affecting income, balance sheet related deferred translation losses of $119 million were recorded in 2009 resulting

primarily from the strengthening U.S. dollar as compared to the British pound, Euro and Canadian dollar. During 2008, we recorded

deferred translation losses of $305 million resulting primarily from the strengthening U.S. dollar as compared to the British pound,

Euro and Canadian dollar. During 2007, we recorded deferred translation gains of $165 million resulting primarily from the stronger

British pound, Euro and Canadian dollar, as compared to the U.S. dollar.

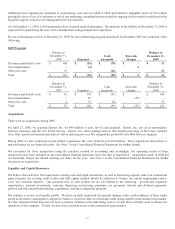

The results of our international operations are subject to currency fluctuations. We enter into foreign exchange contracts primarily to

reduce our risk of loss from such fluctuations. Exchange rates can also impact settlement of our intercompany receivables and

payables that result from transfers of finished goods inventories between our affiliates in different countries, and intercompany loans.

See Note 13 to the Consolidated Financial Statements for further details.

At December 31, 2009, we had $924 million, $2 million and $1 million of foreign exchange contracts outstanding maturing in 2010,

2011, and 2012, respectively, to buy or sell various currencies. As a result of the use of derivative instruments, we are exposed to

counterparty risk. To mitigate such risks, we enter into contracts with only those financial institutions that meet stringent credit

requirements as set forth in our derivative policy. We regularly review our credit exposure balances as well as the creditworthiness of

our counterparties. Maximum risk of loss on these contracts is limited to the amount of the difference between the spot rate at the date

of the contract delivery and the contracted rate.