Pitney Bowes 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

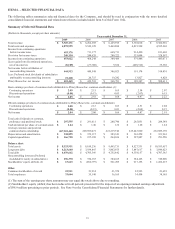

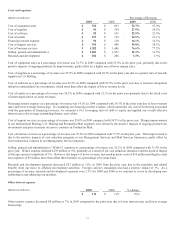

ITEM 6. – SELECTED FINANCIAL DATA

The following tables summarize selected financial data for the Company, and should be read in conjunction with the more detailed

consolidated financial statements and related notes thereto included under Item 8 of this Form 10-K.

Summary of Selected Financial Data

(Dollars in thousands, except per share amounts)

Years ended December 31,

2009 2008 2007 2006 2005

Total revenue $ 5,569,171 $ 6,262,305 $ 6,129,795 $ 5,730,018 $ 5,366,936

Total costs and expenses 4,875,995 5,549,128 5,469,084 4,815,528 4,555,268

Income from continuing operations

before income taxes 693,176 713,177 660,711 914,490 811,668

Provision for income taxes 240,154 244,929 280,222 335,004 328,597

Income from continuing operations 453,022 468,248 380,489 579,486 483,071

(Loss) gain from discontinued operations,

net of income tax (8,109) (27,700) 5,534 (460,312) 35,368

Net income before attribution of

noncontrolling interests 444,913 440,548 386,023 119,174 518,439

Less: Preferred stock dividends of subsidiaries

attributable to noncontrolling interests 21,468 20,755 19,242 13,827 9,828

Pitney Bowes Inc. net income 423,445 $ 419,793 $ 366,781 $ 105,347 $ 508,611

Basic earnings per share of common stock attributable to Pitney Bowes Inc. common stockholders (1):

Continuing operations $ 2.09 $2.15 $ 1.65 $ 2.54 $ 2.07

Discontinued operations (0.04) (0.13) 0.03 (2.07) 0.15

Net income $ 2.05 $2.01 $ 1.68 $ 0.47 $ 2.22

Diluted earnings per share of common stock attributable to Pitney Bowes Inc. common stockholders:

Continuing operations $ 2.08 $2.13 $ 1.63 $ 2.51 $ 2.04

Discontinued operations (0.04) (0.13) 0.03 (2.04) 0.15

Net income $ 2.04 $2.00 $ 1.66 $ 0.47 $ 2.19

Total cash dividends on common,

preference and preferred stock $ 297,555 $ 291,611 $ 288,790 $ 285,051 $ 284,348

Cash dividends per share of common stock $ 1.44 $1.40 $ 1.32 $ 1.28 $ 1.24

Average common and potential

common shares outstanding 207,322,440 209,699,471 221,219,746 225,443,060 232,089,178

Depreciation and amortization $ 338,895 $ 379,117 $ 383,141 $ 363,258 $ 331,963

Capital expenditures $ 166,728 $ 237,308 $ 264,656 $ 327,887 $ 291,550

Balance sheet

Total assets $ 8,533,911 $ 8,810,236 $ 9,465,731 $ 8,527,331 $ 10,553,957

Long-term debt $ 4,213,640 $ 3,934,865 $ 3,802,075 $ 3,847,617 $ 3,849,623

Total debt $ 4,439,662 4,705,366 $ 4,755,842 $ 4,338,157 $ 4,707,365

Noncontrolling interests (Preferred

stockholders' equity in subsidiaries) $ 296,370 $ 374,165 $ 384,165 $ 384,165 $ 310,000

Stockholders’ equity (deficit) (2) $ 13,663 $ (286,779) $ 561,269 $ 617,155 $ 1,282,215

Other

Common stockholders of record 22,911 21,914 21,574 22,923 23,639

Total employees 33,004 35,140 36,165 34,454 34,165

(1) The sum of the earnings per share amounts may not equal the totals above due to rounding.

(2) Stockholders' equity (deficit) has been reduced in all periods presented for the impact of an opening retained earnings adjustment

of $98.9 million pertaining to prior periods. See Note 9 to the Consolidated Financial Statements for further details.

$

$