Pitney Bowes 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

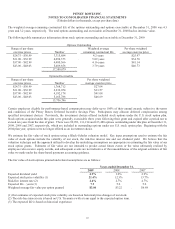

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

68

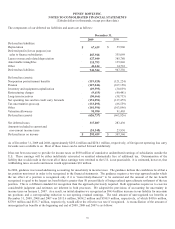

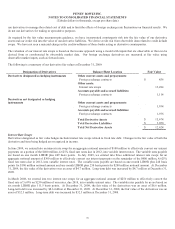

Recurring Fair Value Measurements at December 31, 2009 by Level

Level 1 Level 2 Level 3 Total

Assets:

Investment securities

Money market funds $ 225,581 $ - $ - $ 225,581

Equity securities - 21,027 - 21,027

Debt securities - U.S. and foreign

governments, agencies, and municipalities 53,173 28,754 - 81,927

Corporate notes and bonds - 13,305 - 13,305

Asset-backed securities - 296 - 296

Mortgage-backed securities - 19,708 - 19,708

Derivatives

Interest rate swaps - 13,284 - 13,284

Foreign exchange contracts - 2,390 - 2,390

Total assets $ 278,754 $ 98,764 $ - $ 377,518

Liabilities:

Derivatives

Foreign exchange contracts $ - $ 3,050 $ - $ 3,050

Total liabilities $ - $ 3,050 $ - $ 3,050

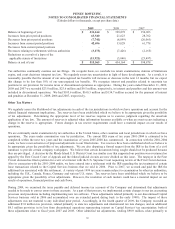

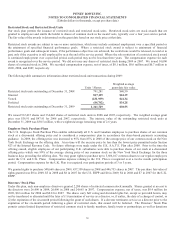

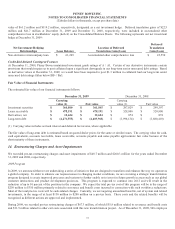

Recurring Fair Value Measurements at December 31, 2008 by Level

Level 1 Level 2 Level 3 Total

Assets:

Investment securities

Money market funds $ 192,980 $ - $ - $ 192,980

Equity securities - 19,541 - 19,541

Debt securities - U.S. and foreign

governments, agencies, and municipalities 30,583 14,411 - 44,994

Corporate notes and bonds - 7,703 - 7,703

Asset-backed securities - 2,658 - 2,658

Mortgage-backed securities - 31,431 - 31,431

Derivatives

Interest rate swaps - 32,486 - 32,486

Total assets $ 223,563 $ 108,230 $ - $ 331,793

Liabilities:

Derivatives

Foreign exchange contracts $ - $ 286 $ - $ 286

Treasury lock and forward starting swaps - 31,326 - 31,326

Total liabilities $ - $ 31,612 $ - $ 31,612

Investment Securities

For our investments, we use the market approach for recurring fair value measurements and the valuation techniques use inputs that

are observable, or can be corroborated by observable data, in an active marketplace.