Pitney Bowes 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

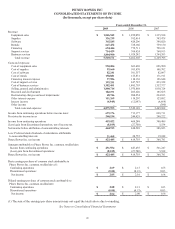

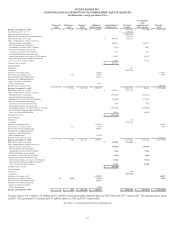

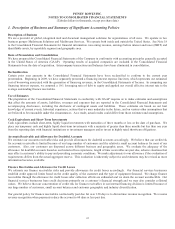

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

50

enable users of the financial statements to evaluate the nature and financial effects of a business combination. Some of the major

impacts of this new guidance include expense recognition for transaction costs and restructuring costs. The adoption of this guidance

has not had a material impact on our financial position, results of operations, or cash flows.

Disclosures about Derivative Instruments and Hedging Activities

On January 1, 2009, we adopted new accounting guidance on disclosures about derivative instruments and hedging activities. The

new guidance impacts disclosures only and requires additional qualitative and quantitative information on the use of derivatives and

their impact on an entity’s financial position, results of operations and cash flows. See Note 13 to the Consolidated Financial

Statements for additional information regarding our derivative instruments and hedging activities.

Fair Value Measurements

On January 1, 2008, we adopted new accounting guidance on fair value measurements. The new guidance defines fair value,

establishes a framework for measuring fair value, and expands disclosures about fair value measurements. It was effective for certain

financial assets and liabilities on January 1, 2008 and for all nonfinancial assets and liabilities recognized or disclosed at fair value on

a nonrecurring basis on January 1, 2009. The adoption of this guidance has not had a material impact on our financial position, results

of operations, or cash flows. See Note 13 to the Consolidated Financial Statements for additional discussion on fair value

measurements.

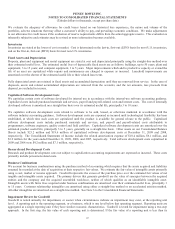

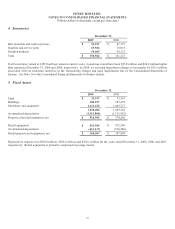

2. Discontinued Operations

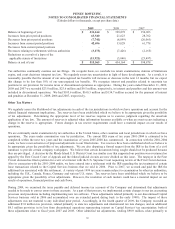

The following table shows selected financial information included in discontinued operations for the years ended December 31:

2009 2008 2007

Pre-tax income $ 20,624 $ - $ -

Tax provision (28,733) (27,700) 5,534

(Loss) gain from discontinued operations, net of tax $ (8,109) $ (27,700) $ 5,534

The 2009 net loss includes $9.8 million of pre-tax income ($6.0 million net of tax) for a bankruptcy settlement received during 2009

and $10.9 million of pre-tax income ($6.7 million net of tax) related to the expiration of an indemnity agreement associated with the

sale of a former subsidiary. This income was more than offset by the accrual of interest on uncertain tax positions. The 2008 net loss

of $27.7 million includes an accrual of tax and interest on uncertain tax positions. The 2007 net gain includes a benefit of $11.3

million and the accrual of $5.8 million of interest expense, both related to uncertain tax positions.

3. Acquisitions

There were no acquisitions during 2009.

On April 21, 2008, we acquired Zipsort, Inc. for $40 million in cash, net of cash acquired. Zipsort, Inc. acts as an intermediary

between customers and the U.S. Postal Service. Zipsort, Inc. offers mailing services that include presorting of first class, standard

class, flats, permit and international mail as well as metering services. We assigned the goodwill to the Mail Services segment.