Pitney Bowes 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share data)

69

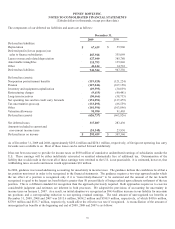

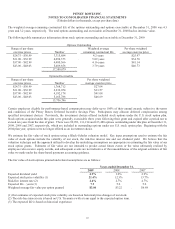

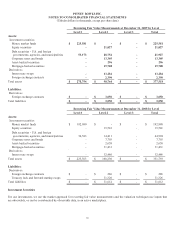

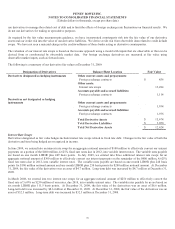

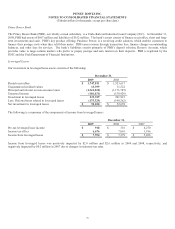

The following information relates to our classification into the fair value hierarchy:

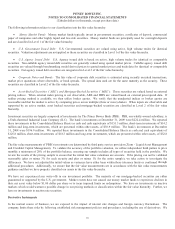

x Money Market Funds: Money market funds typically invest in government securities, certificates of deposit, commercial

paper of companies and other highly liquid and low-risk securities. Money market funds are principally used for overnight deposits

and are classified in Level 1 of the fair value hierarchy.

xU.S. Government Issued Debt: U.S. Governmental securities are valued using active, high volume trades for identical

securities. Valuation adjustments are not applied so these securities are classified in Level 1 of the fair value hierarchy.

xU.S. Agency Issued Debt: U.S. Agency issued debt is based on active, high volume trades for identical or comparable

securities. Non-callable agency issued debt securities are generally valued using quoted market prices. Callable agency issued debt

securities are valued through benchmarking model derived prices to quoted market prices and trade data for identical or comparable

securities. Our agency issued debt securities are categorized in Level 2 of the fair value hierarchy.

xCorporate Notes and Bonds: The fair value of corporate debt securities is estimated using recently executed transactions,

market price quotations where observable, or bond spreads. The spread data used are for the same maturity as the security. These

securities are classified in Level 2 of the fair value hierarchy.

xAsset-Backed Securities (“ABS”) and Mortgage-Backed Securities (“MBS”): These securities are valued based on external

pricing indices. When external index pricing is not observable, ABS and MBS are valued based on external price/spread data. If

neither pricing method is available, we then utilize broker quotes. We verify that the unadjusted indices or broker quotes are

reasonable and that the market is active by comparing prices across multiple (three or more) dealers. When inputs are observable and

supported by an active market, asset backed securities and mortgage-backed securities are classified as Level 2 of the fair value

hierarchy.

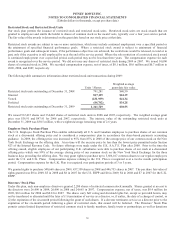

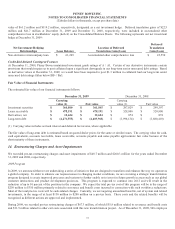

Investment securities are largely composed of investments by The Pitney Bowes Bank (PBB). PBB, our wholly-owned subsidiary, is

a Utah-chartered Industrial Loan Company (ILC). The bank’s investments at December 31, 2009 were $222.4 million. We reported

these investments in the Consolidated Balance Sheets as cash and cash equivalents of $151.3 million, short-term investments of $14.2

million and long-term investments, which are presented within other assets, of $56.9 million. The bank’s investments at December

31, 2008 were $196.9 million. We reported these investments in the Consolidated Balance Sheets as cash and cash equivalents of

$125.8 million, short-term investments of $18.3 million and long-term investments, which are presented within other assets, of $52.8

million.

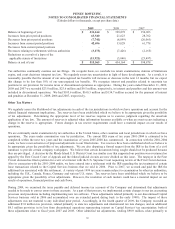

The fair value measurements of PBB’s investments are determined by third party service providers (Zions - Liquid Asset Management

and Utendahl Capital Management). To validate the accuracy of the portfolio valuation, we utilize independent third parties to price

monthly a minimum of 20% of the portfolio balance, ensuring our sample includes all types of securities held in the portfolio. We

review the results of the pricing sample to ensure that the initial fair value valuations are accurate. If the pricing can not be validated

reasonably (plus or minus 3% for each security and plus or minus 1% for the entire sample), we take action to investigate the

differences. We have not adjusted the initial values as variances have either been within these tolerance limits or confirmed through

additional procedures. Additionally, we ensure that the fair value measurements are in accordance with the fair value measurements

guidance and that we have properly classified our assets in the fair value hierarchy.

We have not experienced any write-offs in our investment portfolio. The majority of our mortgage-backed securities are either

guaranteed or supported by the U.S. government. Market events have not caused our money market funds to experience declines in

their net asset value below $1.00 dollar per share or to incur imposed limits on redemptions. We have no investments in inactive

markets which would warrant a possible change in our pricing methods or classification within the fair value hierarchy. Further, we

have no investments in auction rate securities.

Derivative Instruments

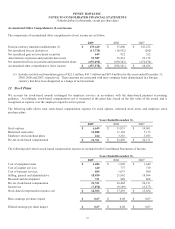

In the normal course of business, we are exposed to the impact of interest rate changes and foreign currency fluctuations. The

company limits these risks by following established risk management policies and procedures, including the use of derivatives. We