Pitney Bowes 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

Additional asset impairments, unrelated to restructuring, were also recorded in 2008 and related to intangible assets of $16 million

principally due to a loss of a customer in one of our marketing consulting businesses and the ongoing shift in market conditions for the

litigation support vertical in our Management Services business.

As of December 31, 2009, 2,999 terminations have occurred under this program. The majority of the liability at December 31, 2009 is

expected to be paid during the next twelve months from cash generated from operations.

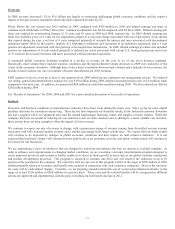

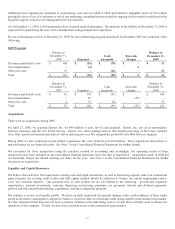

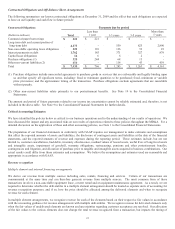

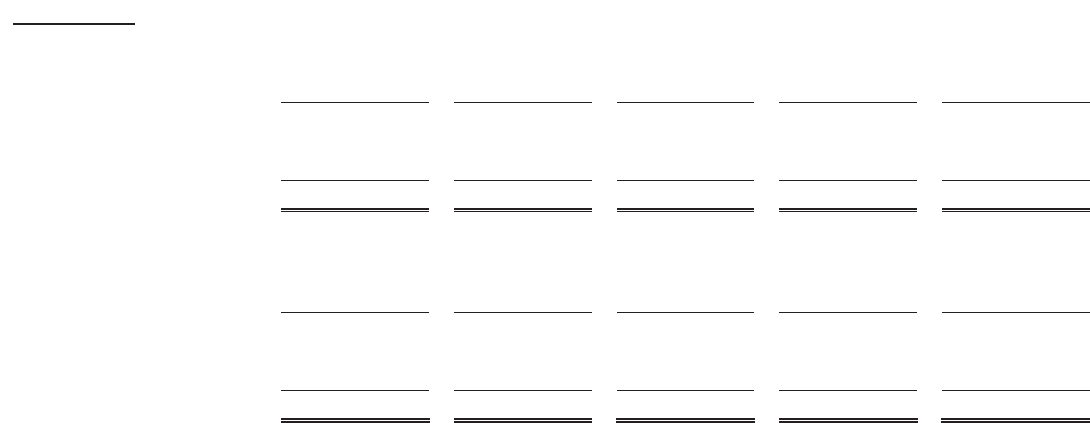

Pre-tax restructuring reserves at December 31, 2009 for the restructuring program announced in November 2007 are composed of the

following:

2007 Program

Balance at

December 31,

2008 Expenses

Cash

payments

Non-cash

charges

Balance at

December 31,

2009

Severance and benefit costs $ 108 $ (15) $ (78) $ - $ 15

Asset impairments - (4) - 4 -

Other exit costs 33 - (12) - 21

Total $ 141 $ (19) $ (90) $ 4 $ 36

Balance at

December 31,

2007 Expenses

Cash

payments

Non-cash

charges

Balance at

December 31,

2008

Severance and benefit costs $ 81 $ 118 $ (91) $ - $ 108

Asset impairments - 47 - (47) -

Other exit costs 6 35 (8) - 33

Total $ 87 $ 200 $ (99) $ (47) $ 141

Acquisitions

There were no acquisitions during 2009.

On April 21, 2008, we acquired Zipsort, Inc. for $40 million in cash, net of cash acquired. Zipsort, Inc. acts as an intermediary

between customers and the U.S. Postal Service. Zipsort, Inc. offers mailing services that include presorting of first class, standard

class, flats, permit and international mail as well as metering services. We assigned the goodwill to the Mail Services segment.

During 2008, we also completed several smaller acquisitions, the costs of which were $30 million. These acquisitions did not have a

material impact on our financial results. See Note 3 to the Consolidated Financial Statements for further details.

We accounted for these acquisitions using the purchase method of accounting and accordingly, the operating results of these

acquisitions have been included in our consolidated financial statements since the date of acquisition. Acquisitions made in 2008 did

not materially impact our diluted earnings per share for the year. See Note 3 to the Consolidated Financial Statements for further

discussion on acquisitions.

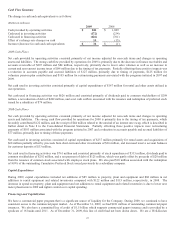

Liquidity and Capital Resources

We believe that cash flow from operations, existing cash and liquid investments, as well as borrowing capacity under our commercial

paper program, the existing credit facility and debt capital markets should be sufficient to finance our capital requirements and to

cover our customer deposits. Our potential uses of cash include but are not limited to the following: growth and expansion

opportunities; internal investments; customer financing; restructuring payments; tax payments; interest and dividend payments;

pension and other benefit plan funding; acquisitions; and share repurchase program.

We continue to review our liquidity profile. We have carefully monitored for material changes in the creditworthiness of those banks

acting as derivative counterparties, depository banks or credit providers to us through credit ratings and the credit default swap market.

We have determined that there has not been a material variation in the underlying sources of cash flows currently used to finance the

operations of the company. To date, we have had consistent access to the commercial paper market.