PG&E 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

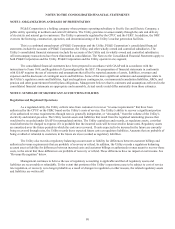

Variable Interest Entities

A VIE is an entity that does not have sufficient equity at risk to finance its activities without additional subordinated

financial support from other parties, or whose equity investors lack any characteristics of a controlling financial interest. An

enterprise that has a controlling financial interest in a VIE is a primary beneficiary and is required to consolidate the VIE.

Some of the counterparties to the Utility’s power purchase agreements are considered VIEs. Each of these VIEs was

designed to own a power plant that would generate electricity for sale to the Utility. To determine whether the Utility was the

primary beneficiary of any of these VIEs at December 31, 2014, it assessed whether it absorbs any of the VIE’s expected losses

or receives any portion of the VIE’s expected residual returns under the terms of the power purchase agreement, analyzed the

variability in the VIE’s gross margin, and considered whether it had any decision-making rights associated with the activities

that are most significant to the VIE’s performance, such as dispatch rights and operating and maintenance activities. The Utility’s

financial obligation is limited to the amount the Utility pays for delivered electricity and capacity. The Utility did not have any

decision-making rights associated with any of the activities that are most significant to the economic performance of any of these

VIEs. Since the Utility was not the primary beneficiary of any of these VIEs at December 31, 2014, it did not consolidate any of

them.

PG&E Corporation affiliates previously entered into four tax equity agreements to fund residential and commercial retail

solar energy installations with four separate privately held funds that were considered VIEs. Since PG&E Corporation was not the

primary beneficiary of any of these VIEs, they were not consolidated. On July 2, 2014, PG&E Corporation disposed of its interest

in the tax equity agreements and has no remaining commitment to fund these agreements.

Other Accounting Policies

For other accounting policies impacting PG&E Corporation’s and the Utility’s consolidated financial statements, see

“Income Taxes” in Note 8, “Derivatives” in Note 9, “Fair Value Measurements” in Note 10, and “Contingencies” in Note 14 of the

Notes to the Consolidated Financial Statements.