PG&E 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

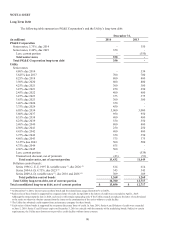

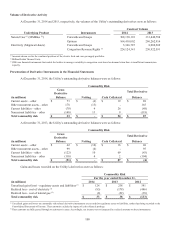

Volume of Derivative Activity

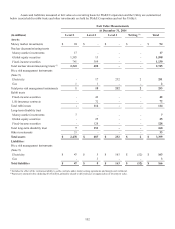

At December 31, 2014 and 2013, respectively, the volumes of the Utility’s outstanding derivatives were as follows:

Contract Volume

Underlying Product Instruments 2014 2013

Natural Gas (1) (MMBtus (2)) Forwards and Swaps 308,130,101 331,840,788

Options 164,418,002 260,262,916

Electricity (Megawatt-hours) Forwards and Swaps 5,346,787 8,089,269

Congestion Revenue Rights (3) 224,124,341 250,922,591

(1) Amounts shown are for the combined positions of the electric fuels and core gas supply portfolios.

(2) Million British Thermal Units.

(3) CRRs are financial instruments that enable the holders to manage variability in congestion costs based on demand when there is insufficient transmission

capacity.

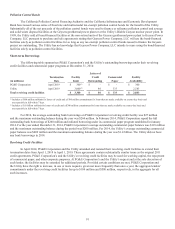

Presentation of Derivative Instruments in the Financial Statements

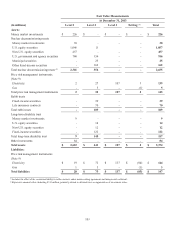

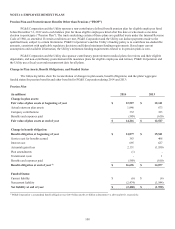

At December 31, 2014, the Utility’s outstanding derivative balances were as follows:

Commodity Risk

Gross

Derivative Total Derivative

(in millions) Balance Netting Cash Collateral Balance

Current assets – other $ 73 $ (4) $ 19 $ 88

Other noncurrent assets – other 178 (13) - 165

Current liabilities – other (78) 4 26 (48)

Noncurrent liabilities – other (140) 13 9 (118)

Total commodity risk $ 33 $ - $ 54 $ 87

At December 31, 2013, the Utility’s outstanding derivative balances were as follows:

Commodity Risk

Gross

Derivative Total Derivative

(in millions) Balance Netting Cash Collateral Balance

Current assets – other $ 42 $ (10) $ 16 $ 48

Other noncurrent assets – other 99 (4) - 95

Current liabilities – other (122) 10 69 (43)

Noncurrent liabilities – other (110) 4 2 (104)

Total commodity risk $ (91) $ - $ 87 $ (4)

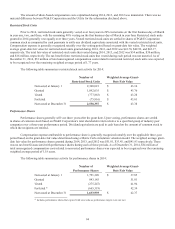

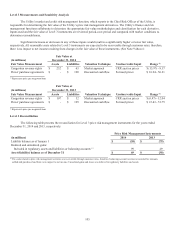

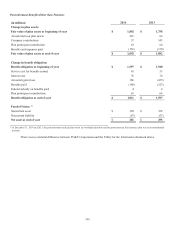

Gains and losses recorded on the Utility’s derivatives were as follows:

Commodity Risk

For the year ended December 31,

(in millions) 2014 2013 2012

Unrealized gain/(loss) - regulatory assets and liabilities (1) $ 124 $ 238 $ 391

Realized loss - cost of electricity (2) (83) (178) (486)

Realized loss - cost of natural gas (2) (8) (22) (38)

Total commodity risk $ 33 $ 38 $ (133)

(1) Unrealized gains and losses on commodity risk-related derivative instruments are recorded to regulatory assets or liabilities, rather than being recorded to the

Consolidated Statements of Income. These amounts exclude the impact of cash collateral postings.

(2) These amounts are fully passed through to customers in rates. Accordingly, net income was not impacted by realized amounts on these instruments.