PG&E 2014 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

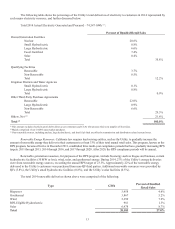

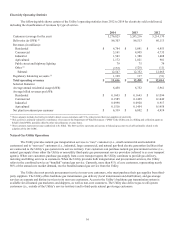

Natural Gas Operating Statistics

The following table shows the Utility’s operating statistics from 2012 through 2014 (excluding subsidiaries) for natural

gas, including the classification of revenues by type of service.

2014 2013 2012

Customers (average for the year) 4,394,283 4,378,797 4,353,278

Gas purchased (MMcf) 202,215 240,414 247,792

Average price of natural gas purchased $ 4.09 $ 3.29 $ 2.45

Bundled gas sales (MMcf):

Residential 143,514 181,775 185,376

Commercial 42,080 46,668 47,341

Total Bundled Gas Sales 185,594 228,443 232,717

Revenues (in millions):

Bundled gas sales:

Residential $1,683 $1,870 $1,852

Commercial 419 395 383

Other 51 44 66

Bundled gas revenues 2,153 2,309 2,301

Transportation service only revenue 662 555 499

Subtotal 2,815 2,864 2,800

Regulatory balancing accounts 617 240 221

Total operating revenues $ 3,432 $ 3,104 $ 3,021

Selected Statistics:

Average annual residential usage (Mcf) 34 44 45

Average billed bundled gas sales revenues per Mcf:

Residential $ 11.72 $ 10.29 $ 9.99

Commercial 9.96 8.47 8.09

Net plant investment per customer $2,468 $2,234 $1,696

Competition

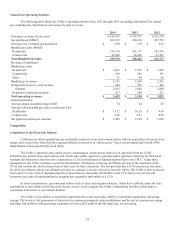

Competition in the Electricity Industry

California law allows qualifying non-residential customers of investor-owned electric utilities to purchase electricity from

energy service providers other than the regulated utilities, (referred to as “direct access”) up to certain annual and overall GWh

limits that have been specified for each utility.

The Utility’s customers may, under certain circumstances, obtain power from a CCA instead of from the Utility.

California law permits cities and counties and certain other public agencies to generate and/or purchase electricity for their local

residents and businesses after they have registered as CCAs and submitted an Implementation Plan to the CPUC. Under these

arrangements, the Utility continues to provide transmission, distribution, metering, and billing services to the customers of the

CCAs and remains the electricity provider of last resort for those customers. The law provides that a CCA can procure electricity

for all of its residents who do not affirmatively elect to continue to receive electricity from the Utility. The Utility is able to recover

from each CCA any costs of implementing the program that are reasonably attributable to the CCA, and to recover from all

customers any costs of implementing the program not reasonably attributable to a CCA.

In some circumstances, governmental entities such as cities and irrigation districts, which have authority under the state

constitution or state statute to provide retail electric service, seek to acquire the Utility’s distribution facilities, either under a

consensual transaction, or via eminent domain.

The Utility is also subject to increased competition due to the increasing viability of distributed generation and energy

storage. The levels of self-generation of electricity by customers (primarily solar installations) and the use of customer net energy

metering, which allows self-generating customers to receive bill credits at the full retail rate, are increasing.