PG&E 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

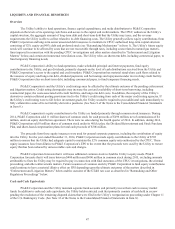

LIQUIDITY AND FINANCIAL RESOURCES

Overview

The Utility’s ability to fund operations, finance capital expenditures, and make distributions to PG&E Corporation

depends on the levels of its operating cash flows and access to the capital and credit markets. The CPUC authorizes the Utility’s

capital structure, the aggregate amount of long-term debt and short-term debt that the Utility may issue, and the revenue

requirements the Utility is able to collect related to its debt financing costs. The Utility generally utilizes equity contributions from

PG&E Corporation and long-term senior unsecured debt issuances to maintain its CPUC-authorized long-term capital structure

consisting of 52% equity and 48% debt and preferred stock (see “Ratemaking Mechanisms” in Item 1). The Utility’s future equity

needs will continue to be affected by costs that are not recoverable through rates, including costs related to natural gas matters,

fines imposed in connection with the pending CPUC investigations and other matters described in “Enforcement and Litigation

Matters” below, and certain environmental remediation costs. The Utility relies on short-term debt, including commercial paper, to

fund temporary financing needs.

PG&E Corporation’s ability to fund operations, make scheduled principal and interest payments, fund equity

contributions to the Utility, and pay dividends, primarily depends on the level of cash distributions received from the Utility and

PG&E Corporation’s access to the capital and credit markets. PG&E Corporation has material stand-alone cash flows related to

the issuance of equity and long-term debt, dividend payments, and borrowings and repayments under its revolving credit facility.

PG&E Corporation relies on short-term debt, including commercial paper, to fund temporary financing needs.

PG&E Corporation’s and the Utility’s credit ratings may be affected by the ultimate outcome of the pending enforcement

and litigation matters. Credit rating downgrades may increase the cost and availability of short-term borrowing, including

commercial paper, the costs associated with credit facilities, and long-term debt costs. In addition, the majority of the Utility’s

derivatives contain collateral posting provisions tied to the Utility’s credit rating from each of the major credit rating agencies. If

the Utility’s credit rating were to fall below investment grade, the Utility would be required to post additional cash immediately to

fully collateralize some of its net liability derivative positions. (See Note 9 of the Notes to the Consolidated Financial Statements

in Item 8.)

PG&E Corporation’s equity contributions to the Utility are funded primarily through common stock issuances. During

2014, PG&E Corporation sold 11 million shares of common stock for cash proceeds of $496 million, net of commissions of $4

million, under an equity distribution agreement. There were no sales during the fourth quarter of 2014. In addition, during 2014,

PG&E Corporation sold 8 million shares of common stock under its 401(k) plan, the Dividend Reinvestment and Stock Purchase

Plan, and share-based compensation plans for total cash proceeds of $306 million.

The proceeds from these equity issuances were used for general corporate purposes, including the contribution of equity

into the Utility. For the year ended December 31, 2014, PG&E Corporation made equity contributions to the Utility of $705

million to ensure that the Utility had adequate capital to maintain the 52% common equity ratio authorized by the CPUC. These

equity issuances have been dilutive to PG&E Corporation’s EPS to the extent that the proceeds were used by the Utility to restore

equity that has been reduced by unrecoverable costs and charges.

PG&E Corporation forecasts that it will issue additional common stock to fund the Utility’s equity needs. PG&E

Corporation forecasts that it will issue between $400 million and $600 million in common stock during 2015, excluding amounts

attributable to fines the Utility may be required to pay in connection with final outcomes of the CPUC investigations, the criminal

proceeding, and other enforcements matters. Future issuances of common stock by PG&E Corporation to fund equity contributions

could continue to have a material dilutive effect on EPS depending upon the ultimate outcomes of the matters described in

“Enforcement and Litigation Matters” below and the outcome of the GT&S rate case as described in “Ratemaking and Other

Regulatory Proceedings” below.

Cash and Cash Equivalents

PG&E Corporation and the Utility maintain separate bank accounts and primarily invest their cash in money market

funds. In addition to cash and cash equivalents, the Utility holds restricted cash that primarily consists of cash held in escrow

pending the resolution of the remaining disputed claims that were filed in the Utility’s reorganization proceeding under Chapter 11

of the U.S. Bankruptcy Code. (See Note 12 of the Notes to the Consolidated Financial Statements in Item 8.)