PG&E 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Financing Activities

The Utility’s financing activities are impacted by the conditions in the capital markets and the maturity date of existing

debt instruments. The Utility forecasts that its financing needs will increase as it incurs non-recoverable pipeline-related costs and

fines associated with the pending investigations and other enforcement matters.

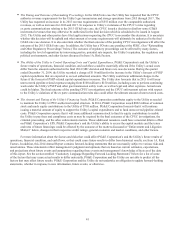

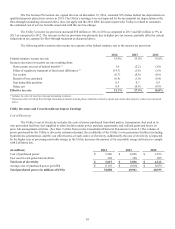

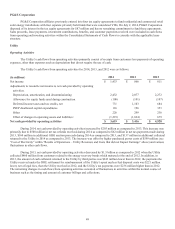

The Utility’s cash flows from financing activities for 2014, 2013, and 2012 were as follows:

(in millions)2014 2013 2012

Net issuances (repayments) of commercial paper, net of discount $ (583) $ 542 $ (1,021)

Proceeds from issuance of short-term debt, net of issuance costs 300 - -

Proceeds from issuance of long-term debt, net of premium, discount, and

issuance costs 1,961 1,532 1,137

Short-term debt matured - - (250)

Repayments of long-term debt (539) (861) (50)

Energy recovery bonds matured - - (423)

Preferred stock dividends paid (14) (14) (14)

Common stock dividends paid (716) (716) (716)

Equity contribution from PG&E Corporation 705 1,140 885

Other 56 (26) 28

Netcashprovidedby(usedin)nancingactivities $ 1,170 $ 1,597 $ (424)

In 2014, net cash provided by financing activities decreased by $427 million compared to the same period in 2013. In

2013, net cash provided by financing activities increased by $2.0 billion compared to 2012. Cash provided by or used in financing

activities is driven by the Utility’s financing needs, which depends on the level of cash provided by or used in operating activities

and the level of cash provided by or used in investing activities.

CONTRACTUAL COMMITMENTS

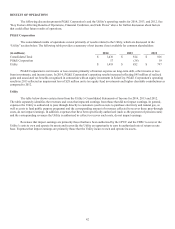

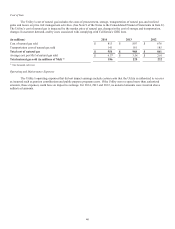

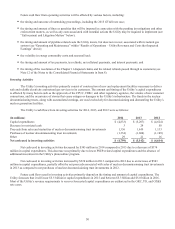

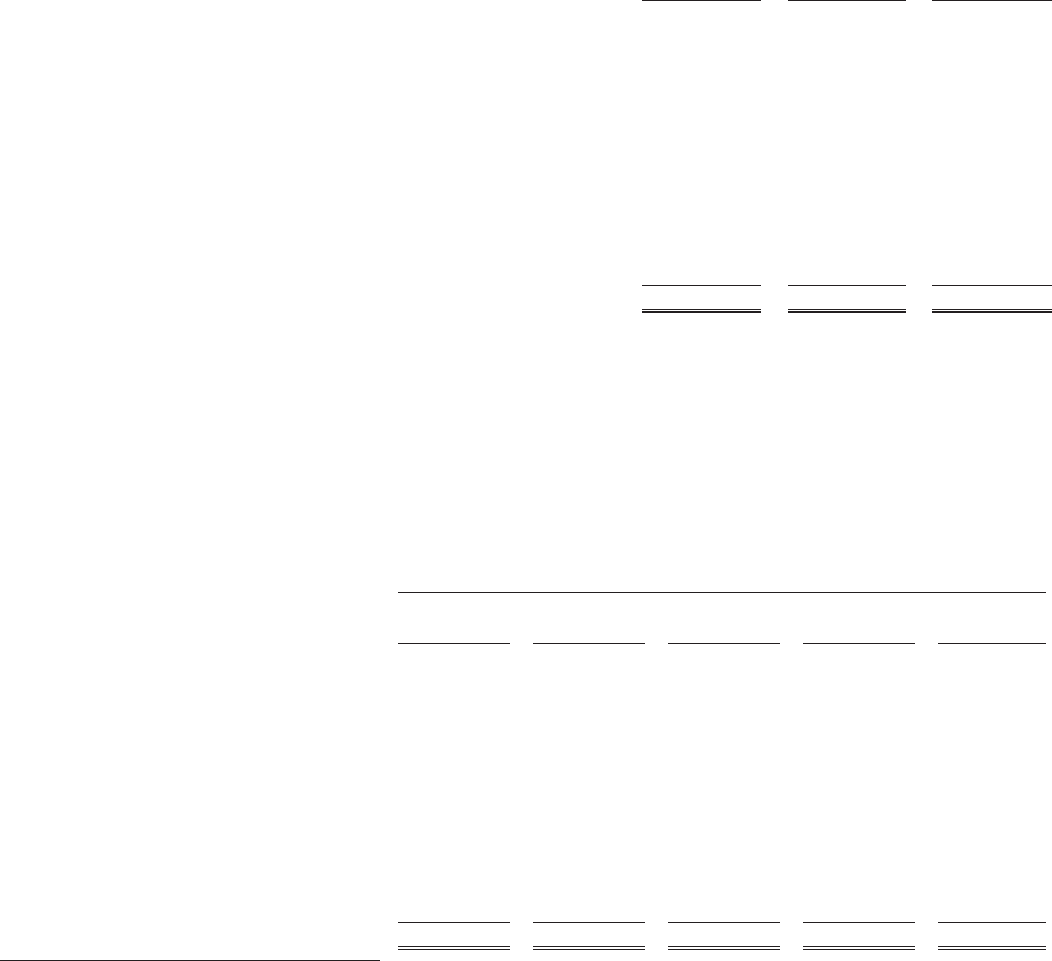

The following table provides information about PG&E Corporation’s and the Utility’s contractual commitments at

December 31, 2014:

Payment due by period

(in millions) Less Than 1-3 3-5 More Than

Utility 1 Year Years Years 5 Years Total

Long-term debt (1): $714 $2,304 $2,870 $21,779 $27,667

Purchase obligations (2):

Power purchase agreements: 3,566 6,839 6,239 33,896 50,540

Natural gas supply, transportation, and storage 544 271 214 648 1,677

Nuclear fuel agreements 138 260 224 429 1,051

Pension and other benets (3) 388 776 776 388 2,328

Operating leases (2) 44 76 57 183 360

Preferred dividends (4) 14 28 28 - 70

PG&E Corporation

Long-term debt (1): 8 16 359 - 383

Total Contractual Commitments $ 5,416 $ 10,570 $ 10,767 $ 57,323 $ 84,076

(1) Includes interest payments over the terms of the debt. Interest is calculated using the applicable interest rate at December 31, 2014 and outstanding principal for

each instrument with the terms ending at each instrument’s maturity. (See Note 4 of the Notes to the Consolidated Financial Statements in Item 8.)

(2) See Note 14 of the Notes to the Consolidated Financial Statements in Item 8.

(3) See Note 11 of the Notes to the Consolidated Financial Statements in Item 8. Payments into the pension and other benefits plans are based on annual contribution

requirements. As these annual requirements continue indefinitely into the future, the amount shown in the column entitled “more than 5 years” represents only

1 year of contributions for the Utility’s pension and other benefit plans.

(4) Based on historical performance, it is assumed for purposes of the table above that dividends are payable within a fixed period of five years.