PG&E 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Future cash flow from operating activities will be affected by various factors, including:

the timing and outcome of ratemaking proceedings, including the 2015 GT&S rate case;

the timing and amount of nes or penalties that will be imposed in connection with the pending investigations and other

enforcement matters, as well as any costs associated with remedial actions the Utility may be required to implement (see

“Enforcement and Litigation Matters” below);

the timing and amount of pipeline-related costs the Utility incurs, but does not recover, associated with its natural gas

system (see “Operating and Maintenance” within “Results of Operations – Utility Revenues and Costs that Impacted

Earnings” above);

the volatility in energy commodity costs and seasonal load;

the timing and amount of tax payments, tax refunds, net collateral payments, and interest payments; and

the timing of the resolution of the Chapter 11 disputed claims and the related refunds passed through to customers (see

Note 12 of the Notes to the Consolidated Financial Statements in Item 8).

Investing Activities

The Utility’s investing activities primarily consist of construction of new and replacement facilities necessary to deliver

safe and reliable electricity and natural gas services to its customers. The amount and timing of the Utility’s capital expenditures

is affected by many factors such as the approvals of the CPUC, FERC, and other regulatory agencies, the volume of new customer

connections, and the occurrence of storms that cause outages or damages to the Utility’s infrastructure. The funds in the nuclear

decommissioning trusts, along with accumulated earnings, are used exclusively for decommissioning and dismantling the Utility’s

nuclear generation facilities.

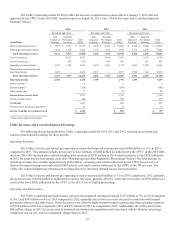

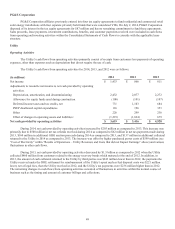

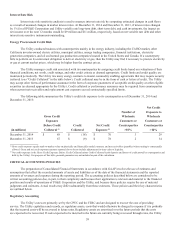

The Utility’s cash flows from investing activities for 2014, 2013, and 2012 were as follows:

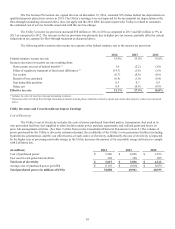

(in millions)2014 2013 2012

Capital expenditures $ (4,833) $ (5,207) $ (4,624)

Decrease in restricted cash 3 29 50

Proceeds from sales and maturities of nuclear decommissioning trust investments 1,336 1,619 1,133

Purchases of nuclear decommissioning trust investments (1,334) (1,604) (1,189)

Other 29 21 16

Net cash used in investing activities $ (4,799) $ (5,142) $ (4,614)

Net cash used in investing activities decreased by $343 million in 2014 compared to 2013 due to a decrease of $374

million in capital expenditures. This decrease was primarily due to lower PSEP-related capital expenditures and the absence of

additional investment in the Utility’s photovoltaic program.

Net cash used in investing activities increased by $528 million in 2013 compared to 2012 due to an increase of $583

million in capital expenditures, partially offset by net proceeds associated with sales of nuclear decommissioning trust investments

in 2013 as compared to net purchases of nuclear decommissioning trust investments in 2012.

Future cash flows used in investing activities primarily depend on the timing and amount of capital expenditures. The

Utility forecasts that it will incur $5.5 billion in capital expenditures in 2015 and between $5.3 billion and $5.8 billion in 2016.

Most of the Utility’s revenue requirements to recover forecasted capital expenditures are authorized in the GRC, TO, and GT&S

rate cases.