PG&E 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.11

Revenues to Recover Energy Procurement and Other Pass-Through Costs

Electricity Procurement Costs

California investor-owned electric utilities are responsible for procuring electricity required to meet customer demand,

plus applicable reserve margins, that are not satisfied from their own generation facilities and existing electricity contracts. The

utilities are responsible for scheduling and bidding electric generation resources, including electricity procured from third parties

or the wholesale market, to meet customer demand according to which resources are the least expensive (i.e., using the principles

of “least-cost dispatch”). In addition, the utilities are required to obtain CPUC approval of their procurement plans based on long-

term demand forecasts. In January 2012, the CPUC approved the Utility’s procurement plan (covering 2012 through 2020).

California law allows electric utilities to recover the costs incurred in compliance with their CPUC-approved electricity

procurement plans without further after-the-fact reasonableness review. Costs associated with electricity purchases may be

disallowed if they are not in compliance with the CPUC-approved plan or if the utility failed to follow the principles of least-cost

dispatch. The Utility recovers its electricity procurement costs annually through the energy resource recovery account (“ERRA”).

(See Note 3 of the Notes to the Consolidated Financial Statements in Item 8.) Each year, the CPUC reviews the Utility’s forecasted

procurement costs related to power purchase agreements, derivative instruments, GHG costs, and generation fuel expense

and approves a forecasted revenue requirement. The CPUC may adjust a utility’s retail electricity rates more frequently if the

forecasted aggregate over-collections or under-collections in the ERRA exceed five percent of its prior year electricity procurement

revenues. The CPUC performs an annual compliance review of the transactions recorded in the ERRA.

The CPUC has approved various power purchase agreements that the Utility has entered into with third parties in

accordance with the Utility’s CPUC-approved procurement plan, the renewable energy mandate, and resource adequacy

requirements. See “Electric Utility Operations – Electricity Resources” below as well as Note 14 of the Notes to the Consolidated

Financial Statements in Item 8 for additional information.

Natural Gas Procurement and Transportation Costs

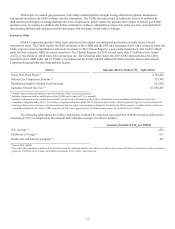

The Utility sets the natural gas procurement rate for small commercial and residential customers (referred to as “core”

customers) monthly, based on the forecasted costs of natural gas, core pipeline capacity and storage costs. The Utility recovers

the cost of gas purchased on behalf of core customers as well as the cost of derivative instruments through its retail gas rates

subject to limits as set forth in its Core Procurement Incentive Mechanism (“CPIM”). The Utility reflects the difference between

actual natural gas purchase costs and forecasted natural gas purchase costs in several natural gas balancing accounts, with under-

collections and over-collections taken into account in subsequent monthly rates. This is accomplished through monthly advice

letters that are effective upon filing. The Utility recovers the cost of gas used in generation facilities as a cost of electricity that is

recovered annually through retail electricity rates.

The CPIM protects the Utility against after-the-fact reasonableness reviews of these gas procurement costs. Under the

CPIM, the Utility’s natural gas purchase costs for a fixed 12-month period are compared to an aggregate market-based benchmark

based on a weighted average of published monthly and daily natural gas price indices at the points where the Utility typically

purchases natural gas. Costs that fall within a tolerance band, which is 99% to 102% of the commodity benchmark, are considered

reasonable and are fully recovered in customers’ rates. One-half of the costs above 102% of the benchmark are recoverable in

customers’ rates, and the Utility’s customers receive in their rates 80% of any savings resulting from the Utility’s cost of natural

gas that is less than 99% of the benchmark. The Utility retains the remaining amount of savings as incentive revenues, subject to a

cap equal to 1.5% of total natural gas commodity costs. While this incentive mechanism remains in place, changes in the price of

natural gas, consistent with the market-based benchmark, are not expected to materially impact net income.

The Utility incurs transportation costs under various agreements with interstate and Canadian third-party transportation

service providers. These providers transport natural gas from the points at which the Utility takes delivery of natural gas

(typically in Canada, the U.S. Rocky Mountains, and the southwestern United States) to the points at which the Utility’s natural

gas transportation system begins. These agreements are governed by FERC-approved tariffs that detail rates, rules, and terms of

service for the provision of natural gas transportation services to the Utility on interstate and Canadian pipelines. United States

tariffs are approved for each pipeline for service to all of its shippers, including the Utility, by the FERC in a FERC ratemaking

review process, and the applicable Canadian tariffs are approved by the Alberta Utilities Commission and the National Energy

Board. The transportation costs the Utility incurs under these agreements are recovered through CPUC-approved rates as core

natural gas procurement costs or as a cost of electricity.