PG&E 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

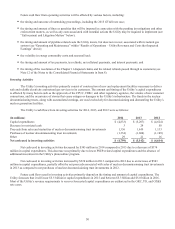

48

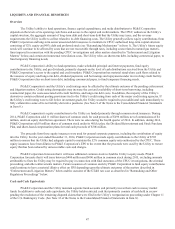

Revolving Credit Facilities and Commercial Paper Programs

At December 31, 2014, PG&E Corporation and the Utility had $300 million and $2.6 billion available under their

respective $300 million and $3.0 billion revolving credit facilities. (See Note 4 of the Notes to the Consolidated Financial

Statements in Item 8.)

The revolving credit facilities require that PG&E Corporation and the Utility maintain a ratio of total consolidated debt

to total consolidated capitalization of at most 65% as of the end of each fiscal quarter. PG&E Corporation’s revolving credit

facility agreement also requires that PG&E Corporation own, directly or indirectly, at least 80% of the common stock and at least

70% of the voting capital stock of the Utility. In addition, these revolving credit facilities include usual and customary provisions

regarding events of default and covenants limiting liens to those permitted under PG&E Corporation’s and the Utility’s senior note

indentures, mergers, sales of all or substantially all of PG&E Corporation’s and the Utility’s assets, and other fundamental changes.

At December 31, 2014, PG&E Corporation and the Utility were in compliance with all covenants under their respective revolving

credit facilities.

2014 Debt Financings

PG&E Corporation and the Utility issued $2.3 billion in long-term debt and $300 million in short-term debt during the

year ended December 31, 2014. (See Note 4 of the Notes to the Consolidated Financial Statements in Item 8.)

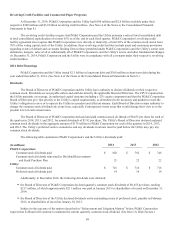

Dividends

The Board of Directors of PG&E Corporation and the Utility have authority to declare dividends on their respective

common stock. Dividends are not payable unless and until declared by the applicable Board of Directors. The CPUC requires that

the Utility maintain, on average, its authorized capital structure including a 52% equity component and that the PG&E Corporation

Board of Directors give first priority to the Utility’s capital requirements, as determined to be necessary and prudent to meet the

Utility’s obligation to serve or to operate the Utility in a prudent and efficient manner. Each Board of Directors retains authority to

change the common stock dividend rate at any time, especially if unexpected events occur that would change their view as to the

prudent level of cash conservation.

The Board of Directors of PG&E Corporation declared and paid common stock dividends of $0.455 per share for each of

the quarters in 2014, 2013, and 2012, for annual dividends of $1.82 per share. The Utility’s Board of Directors declared and paid

common stock dividends in the aggregate amount of $179 million to PG&E Corporation for each of the quarters in 2014, 2013,

and 2012. The Utility’s preferred stock is cumulative and any dividends in arrears must be paid before the Utility may pay any

common stock dividends.

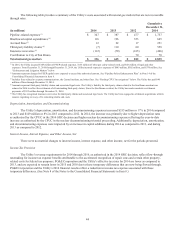

The following table summarizes PG&E Corporation’s and the Utility’s dividends paid:

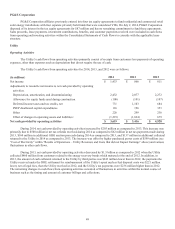

(in millions)2014 2013 2012

PG&E Corporation:

Common stock dividends paid $ 802 $782 $746

Common stock dividends reinvested in Dividend Reinvestment

and Stock Purchase Plan 21 22 22

Utility:

Common stock dividends paid $ 716 $716 $716

Preferred stock dividends paid 14 14 14

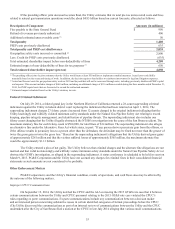

Additionally, in December 2014, the following dividends were declared:

the Board of Directors of PG&E Corporation declared quarterly common stock dividends of $0.455 per share, totaling

$217 million, of which approximately $211 million was paid in January 2015 to shareholders of record on December 31,

2014;

the Board of Directors of the Utility declared dividends on its outstanding series of preferred stock, payable in February

2015, to shareholders of record on January 30, 2015.

Subject to the outcome of the matters described in “Enforcement and Litigation Matters” below, PG&E Corporation

expects that its Board will continue to maintain the current quarterly common stock dividend. (See Item 1A. Risk Factors.)