PG&E 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

Information regarding the beneficial ownership of securities for each of PG&E Corporation and the Utility is set forth

under the headings “Share Ownership Information – Security Ownership of Management” and “Share Ownership Information –

Principal Shareholders” in the Joint Proxy Statement relating to the 2015 Annual Meetings of Shareholders, which information is

incorporated herein by reference.

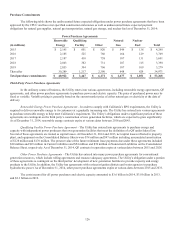

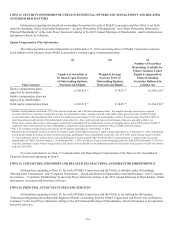

Equity Compensation Plan Information

The following table provides information as of December 31, 2014 concerning shares of PG&E Corporation common

stock authorized for issuance under PG&E Corporation’s existing equity compensation plans.

(a) (b) (c)

Plan Category

Number of Securities to

be Issued Upon Exercise

of Outstanding Options,

Warrants and Rights

Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding

SecuritiesReectedin

Column (a))

Equity compensation plans

approved by shareholders 6,303,612 (1) $ 34.83 (2) 16,184,126 (3)

Equity compensation plans not

approved by shareholders ---

Total equity compensation plans 6,303,612 (1) $ 34.83 (2) 16,184,126 (3)

(1) Includes 45,660 phantom stock units, 2,571,530 restricted stock units and 3,659,066 performance shares. The weighted average exercise price reported

in column (b) does not take these awards into account. For performance shares, amounts reflected in this table assume payout in shares at 200% of target

or, for performance shares granted in 2012, reflects the actual payout percentage of 35%. The actual number of shares issued can range from 0% to 200% of

target depending on achievement of total shareholder return objectives. Also, restricted stock units and performance shares are generally settled in net

shares. Upon vesting, shares with a value equal to required tax withholding will be withheld and, in lieu of issuing the shares, taxes will be paid on behalf of

employees. Shares not issued due to share withholding or performance achievement below maximum will be available again for issuance.

(2) This is the weighted average exercise price for the 26,756 options outstanding as of December 31, 2014.

(3) Represents the total number of shares available for issuance under all of PG&E Corporation’s equity compensation plans as of December 31, 2014. Stock-based

awards granted under these plans include restricted stock units, performance shares and phantom stock units. The 2014 LTIP, which became effective on May

12, 2014, authorizes up to 17 million shares to be issued pursuant to awards granted under the 2014 LTIP, less approximately 2.7 million shares for awards

granted under the 2006 LTIP from January 1, 2014 through May 11, 2014. In addition, if any awards outstanding under the 2006 LTIP at December 31, 2013 are

cancelled, forfeited or expire without being settled in full, shares of stock allocable to the terminated portion of such awards shall again be available for issuance

under the 2014 LTIP.

For more information, see Note 5: Common Stock and Share-Based Compensation of the Notes to the Consolidated

Financial Statements appearing in Item 8.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Information responding to Item 13, for each of PG&E Corporation and the Utility, is included under the headings

“Related Party Transactions” and “Corporate Governance – Board and Director Independence and Qualifications” and “Corporate

Governance – Committee Membership” in the Joint Proxy Statement relating to the 2015 Annual Meetings of Shareholders, which

information is incorporated herein by reference.

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Information responding to Item 14, for each of PG&E Corporation and the Utility, is set forth under the heading

“Information Regarding the Independent Registered Public Accounting Firm for PG&E Corporation and Pacific Gas and Electric

Company” in the Joint Proxy Statement relating to the 2015 Annual Meetings of Shareholders, which information is incorporated

herein by reference.