PG&E 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

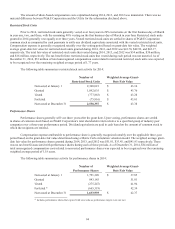

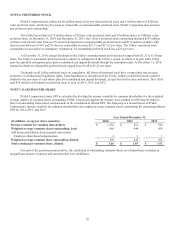

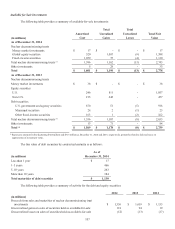

Unrecognized tax benefits

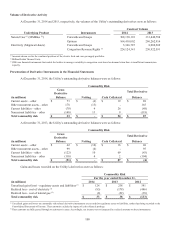

The following table reconciles the changes in unrecognized tax benefits:

PG&E Corporation Utility

2014 2013 2012 2014 2013 2012

(in millions)

Balance at beginning of year $ 666 $ 581 $ 506 $ 660 $ 575 $ 503

Additions for tax position taken

during a prior year 7 12 32 7 12 26

Reductions for tax position

taken during a prior year (9) (6) (13) (9) (6) (10)

Additions for tax position

taken during the current year 61 79 67 61 79 67

Settlements (12) - (11) (12) - (11)

Balance at end of year $ 713 $ 666 $ 581 $ 707 $ 660 $ 575

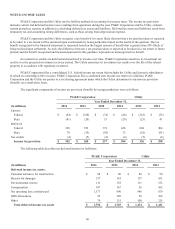

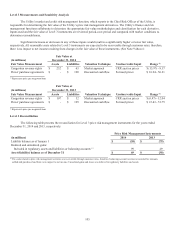

The component of unrecognized tax benefits that, if recognized, would affect the effective tax rate at December 31, 2014

for PG&E Corporation and the Utility was $20 million, with the remaining balance representing the potential deferral of taxes to

later years.

PG&E Corporation’s and the Utility’s unrecognized tax benefits may change significantly within the next 12 months

depending on the IRS guidance that is issued and the resolution of the audits related to the 2011, 2012, and 2013 tax returns (see

“2014 GRC impact” below). As of December 31, 2014, it is reasonably possible that unrecognized tax benefits will decrease by

approximately $330 million within the next 12 months, and most of this decrease would not impact net income.

Interest income, interest expense and penalties associated with income taxes are reflected in income tax expense on the

Consolidated Statements of Income. For the years ended December 31, 2014, 2013, and 2012, these amounts were immaterial.

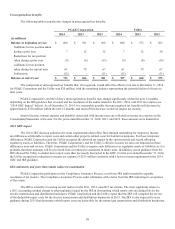

2014 GRC impact

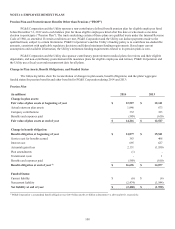

The 2014 GRC decision authorized revenue requirements that reflect flow-through ratemaking for temporary income

tax differences attributable to repair costs and certain other property-related costs for federal tax purposes. For these temporary

differences, PG&E Corporation and the Utility recognize the deferred tax impact in the current period and record offsetting

regulatory assets or liabilities. Therefore, PG&E Corporation’s and the Utility’s effective income tax rates are impacted as these

differences arise and reverse. PG&E Corporation and the Utility recognize such differences as regulatory assets or liabilities as it is

probable that these amounts will be recovered from or returned to customers in future rates. In addition, recent guidance from the

IRS allowed the Utility to deduct more repair costs than previously forecasted in the GRC. For the year ended December 31, 2014,

the Utility recognized a reduction in income tax expense of $235 million consistent with a lower revenue requirement in the 2014

GRC and IRS guidance.

IRS settlements and years that remain subject to examination

PG&E Corporation participates in the Compliance Assurance Process, a real-time IRS audit intended to expedite

resolution of tax matters. The Compliance Assurance Process audit culminates with a letter from the IRS indicating its acceptance

of the return.

The IRS is currently reviewing several matters in the 2011, 2012, and 2013 tax returns. The most significant relates to

a 2011 accounting method change to adopt guidance issued by the IRS in determining which repair costs are deductible for the

electric transmission and distribution businesses. PG&E Corporation and the Utility expect that the IRS will complete the review

of the deductible repair costs for the electric transmission and distribution businesses in 2015. The IRS is also expected to issue

guidance during 2015 that determines which repair costs are deductible for the natural gas transmission and distribution businesses.