PG&E 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

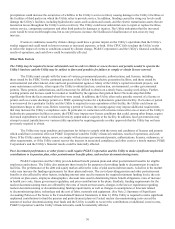

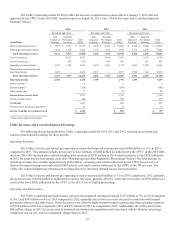

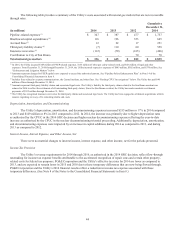

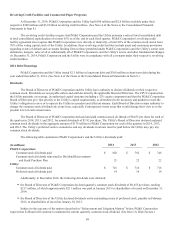

Summary of Changes in Net Income and Earnings per Share

PG&E Corporation’s financial results for 2014 reflect an increase in the Utility’s revenues as authorized in the CPUC’s

final decision issued in the Utility’s 2014 GRC on August 14, 2014. (See “Results of Operations” below.)

The following table is a summary reconciliation of the key changes, after-tax, in PG&E Corporation’s income available

for common shareholders and EPS for the year ended December 31, 2014 compared to the prior year (see “Results of Operations”

below for additional information):

EPS

(in millions, except per share amounts) Earnings (diluted)

Income Available for Common Shareholders - 2013 $814 $ 1.83

Natural gas matters (1) 176 0.43

2014 GRC expense recovery(2) 134 0.29

Tax benet - repairs method and forecast change (3) 115 0.24

Growth in rate base earnings (4) 101 0.21

Gain on disposition of SolarCity stock 27 0.06

Regulatory matters (5) 20 0.04

Gas transmission revenues 8 0.02

Uneconomic project and lease termination 8 0.02

Increase in shares outstanding (6) -(0.15)

Other 33 0.07

Income Available for Common Shareholders - 2014 $ 1,436 $ 3.06

(1) Represents the decrease in net costs related to natural gas matters during 2014 as compared to 2013. These amounts are not recoverable through rates. See

“Results of Operations - Operating and Maintenance” below.

(2) In 2013, the Utility incurred approximately $200 million of expense and $1 billion of capital costs above authorized levels. The 2014 GRC decision authorized

revenues that support this higher level of spending in 2014 and throughout the GRC period. The amounts in the table represent the after-tax higher authorized

revenue recognized during 2014, for the recovery of these expenses and costs.

(3) Represents the favorable impact of recent IRS guidance and forecast changes based on flow-through ratemaking treatment for federal tax deductions resulting

from temporary differences attributable to the accelerated recognition of repairs and certain other property-related costs, as reflected in the revenue requirements

authorized in the 2014 GRC decision. See “Income Tax Provision” below.

(4) Represents the impact of the increase in rate base as authorized in various rate cases, including the 2014 GRC, during 2014 as compared to 2013.

(5) Includes customer energy efficiency incentive awards.

(6) Represents the impact of a higher number of weighted average shares of common stock outstanding during 2014 as compared to 2013. PG&E Corporation issues

shares to fund its equity contributions to the Utility to maintain the Utility’s capital structure and fund operations, including unrecovered expenses.

Key Factors Affecting Results of Operations, Financial Condition, and Cash Flows

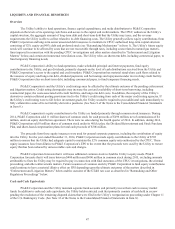

PG&E Corporation and the Utility believe that their future results of operations, financial condition, and cash flows will

be materially affected by the following factors:

The Outcome of Pending Investigations and Enforcement Matters. The assigned CPUC ALJs overseeing the three pending

investigations regarding the Utility’s gas transmission system and the San Bruno accident have issued decisions to impose

total nes and disallowances of $1.4 billion on the Utility. The Utility and other parties have appealed the decisions

and several Commissioners have requested reviews of the decisions. It is uncertain when the nal outcome of these

investigations will be determined. At December 31, 2014, the Consolidated Balance Sheets included an accrual of $200 million

for the minimum amount of nes deemed probable. There is also a pending federal criminal indictment against the Utility

alleging that the Utility knowingly and willfully violated the Pipeline Safety Act and illegally obstructed the NTSB’s

investigation into the cause of the San Bruno accident. Based on the superseding indictment’s allegations, the maximum

statutory ne would be $14 million and the maximum alternative ne would be approximately $1.13 billion. Federal and

state authorities also are conducting investigations in connection with certain communications between the Utility and

CPUC personnel. Fines may be imposed, or other regulatory or governmental enforcement action could be taken, with

respect to these and other enforcement matters. (See “Enforcement and Litigation Matters” below.)