PG&E 2014 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

149

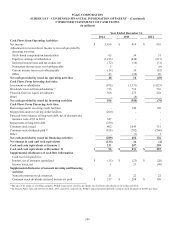

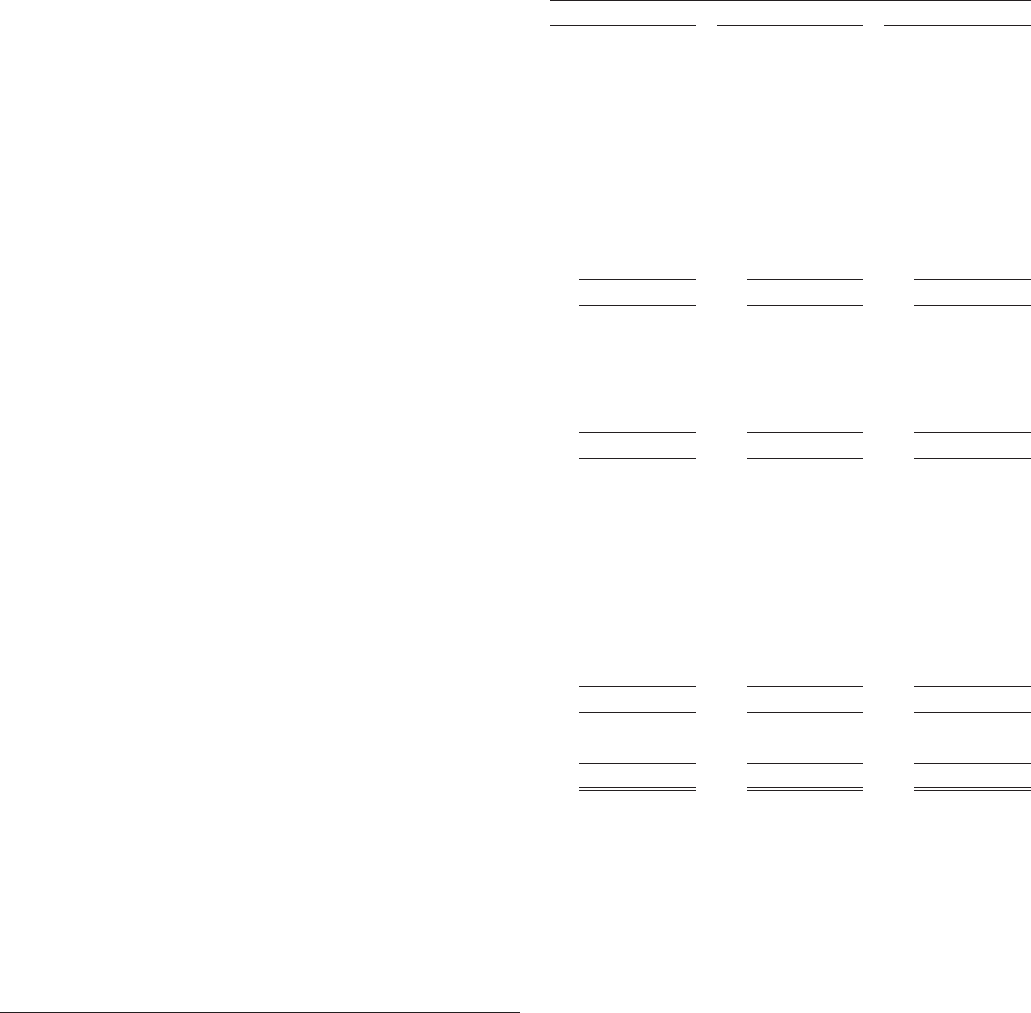

PG&E CORPORATION

SCHEDULE I – CONDENSED FINANCIAL INFORMATION OF PARENT – (Continued)

CONDENSED STATEMENTS OF CASH FLOWS

(in millions)

Year Ended December 31,

2014 2013 2012

Cash Flows from Operating Activities:

Net income $ 1,436 $ 814 $ 816

Adjustments to reconcile net income to net cash provided by

operating activities:

Stock-based compensation amortization 65 54 51

Equity in earnings of subsidiaries (1,413) (848) (817)

Deferred income taxes and tax credits, net (72) (10) (31)

Noncurrent income taxes receivable/payable 5 - (6)

Current income taxes receivable/payable (16) 20 (82)

Other 43 (20) 20

Net cash provided by (used in) operating activities 48 10 (49)

Cash Flows From Investing Activities:

Investment in subsidiaries (978) (1,371) (1,023)

Dividends received from subsidiaries (1) 716 716 716

Proceeds from tax equity investments 368 275 228

Other - (8) -

Net cash provided by (used in) investing activities 106 (388) (79)

Cash Flows From Financing Activities:

Borrowings under revolving credit facilities - 140 120

Repayments under revolving credit facilities (260) - -

Proceeds from issuance of long-term debt, net of discount and

issuance costs of $3 in 2014 347 - -

Repayments of long-term debt (350) - -

Common stock issued 802 1,045 751

Common stock dividends paid (2) (828) (782) (746)

Other - (1) 1

Net cash provided by (used in) financing activities (289) 402 126

Net change in cash and cash equivalents (135) 24 (2)

Cash and cash equivalents at January 1 231 207 209

Cash and cash equivalents at December 31 $ 96 $ 231 $ 207

Supplemental disclosures of cash flow information

Cash received (paid) for:

Interest, net of amounts capitalized $ (15) $ (23) $ (20)

Income taxes, net 1 21 (60)

Supplemental disclosures of noncash investing and financing

activities

Noncash common stock issuances 21 22 22

Common stock dividends declared but not yet paid $ 217 $ 208 $ 196

(1) Because of its nature as a holding company, PG&E Corporation classifies dividends received from subsidiaries an investing cash flow.

(2) In January, April, July, and October of 2014, 2013, and 2012, respectively, PG&E Corporation paid quarterly common stock dividends of $0.455 per share.