PG&E 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

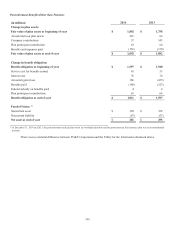

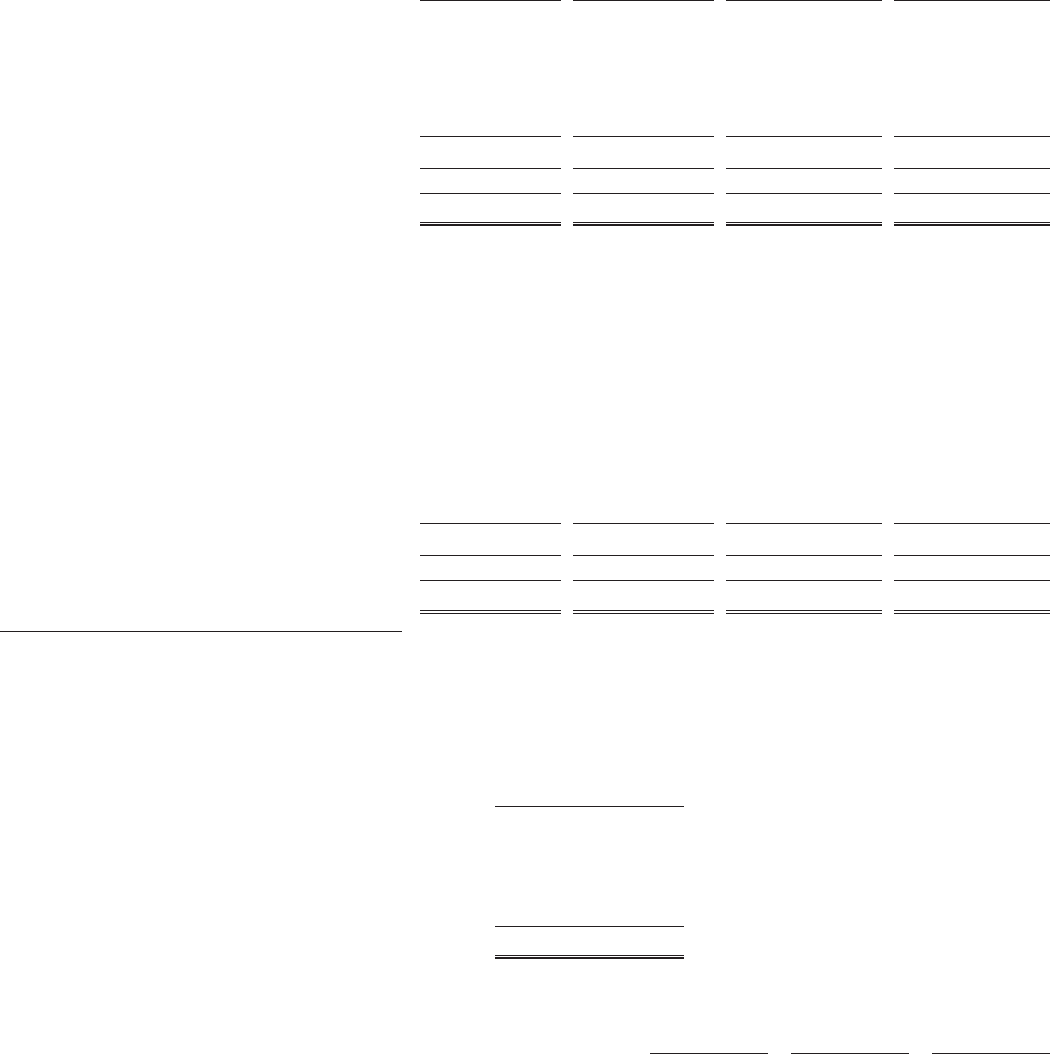

Available for Sale Investments

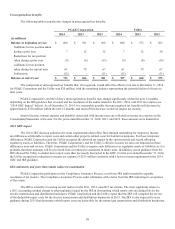

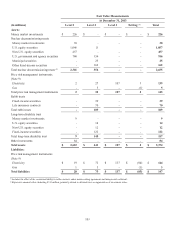

The following table provides a summary of available-for-sale investments:

Total Total

Amortized Unrealized Unrealized Total Fair

(in millions) Cost Gains Losses Value

As of December 31, 2014

Nuclear decommissioning trusts

Money market investments $ 17 $ - $ - $ 17

Global equity securities 520 1,087 (9) 1,598

Fixed-income securities 1,059 75 (4) 1,130

Total nuclear decommissioning trusts (1) 1,596 1,162 (13) 2,745

Other investments 5 28 - 33

Total $ 1,601 $ 1,190 $ (13) $ 2,778

As of December 31, 2013

Nuclear decommissioning trusts

Money market investments $ 38 $ - $ - $ 38

Equity securities

U.S. 246 811 - 1,057

Non-U.S. 215 242 - 457

Debt securities

U.S. government and agency securities 870 51 (5) 916

Municipal securities 24 2 (1) 25

Other xed-income securities 163 1 (2) 162

Total nuclear decommissioning trusts (1) 1,556 1,107 (8) 2,655

Other investments 13 71 - 84

Total (1) $ 1,569 $ 1,178 $ (8) $ 2,739

(1) Represents amounts before deducting $324 million and $313 million at December 31, 2014 and 2013, respectively, primarily related to deferred taxes on

appreciation of investment value.

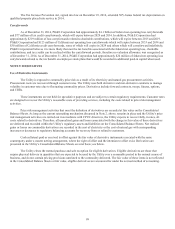

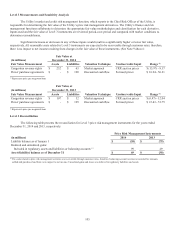

The fair value of debt securities by contractual maturity is as follows:

As of

(in millions) December 31, 2014

Less than 1 year $ 17

1–5 years 466

5–10 years 263

More than 10 years 384

Total maturities of debt securities $ 1,130

The following table provides a summary of activity for the debt and equity securities:

2014 2013 2012

(in millions)

Proceeds from sales and maturities of nuclear decommissioning trust

investments $ 1,336 $ 1,619 $ 1,133

Gross realized gains on sales of securities held as available-for-sale 118 94 19

Gross realized losses on sales of securities held as available-for-sale (12) (13) (17)