PG&E 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116

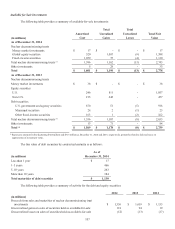

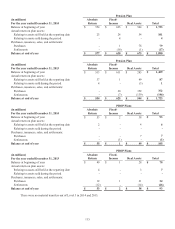

Cash Flow Information

Employer Contributions

PG&E Corporation and the Utility contributed $332 million to the pension benefit plans and $57 million to the other

benefit plans in 2014. These contributions are consistent with PG&E Corporation’s and the Utility’s funding policy, which

is to contribute amounts that are tax-deductible and consistent with applicable regulatory decisions and federal minimum

funding requirements. None of these pension or other benefits were subject to a minimum funding requirement requiring a

cash contribution in 2014. The Utility’s pension benefits met all the funding requirements under ERISA. PG&E Corporation

and the Utility expect to make total contributions of approximately $327 million and $61 million to the pension plan and other

postretirement benefit plans, respectively, for 2015.

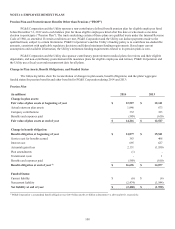

Benefits Payments and Receipts

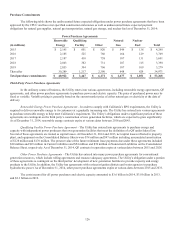

As of December 31, 2014, the estimated benefits expected to be paid and the estimated federal subsidies expected to be

received in each of the next five fiscal years, and in aggregate for the five fiscal years thereafter, are as follows:

Pension PBOP Federal

(in millions) Plan Plans Subsidy

2015 $ 653 $ 91 $ (7)

2016 696 96 (8)

2017 737 102 (8)

2018 775 109 (9)

2019 812 115 (10)

Thereafter in the succeeding ve years 4,545 614 (29)

There were no material differences between the estimated benefits expected to be paid by PG&E Corporation and paid by

the Utility for the years presented above. There were also no material differences between the estimated subsidies expected to be

received by PG&E Corporation and received by the Utility for the years presented above.

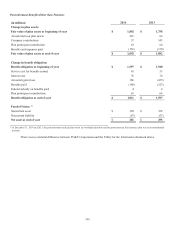

Retirement Savings Plan

PG&E Corporation sponsors a retirement savings plan, which qualifies as a 401(k) defined contribution benefit plan under

the Internal Revenue Code 1986, as amended. This plan permits eligible employees to make pre-tax and after-tax contributions

into the plan, and provide for employer contributions to be made to eligible participants. Total expenses recognized for defined

contribution benefit plans reflected in PG&E Corporation’s Consolidated Statements of Income were $80 million, $71 million, and

$67 million in 2014, 2013, and 2012, respectively.

There were no material differences between the employer contribution expense for PG&E Corporation and the Utility for

the years presented above.