PG&E 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.99

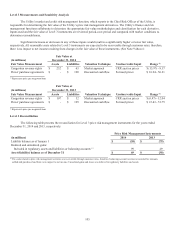

The Tax Increase Prevention Act, signed into law on December 19, 2014, extended 50% bonus federal tax depreciation on

qualified property placed into service in 2014.

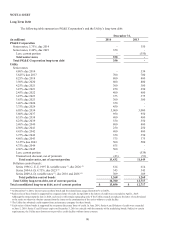

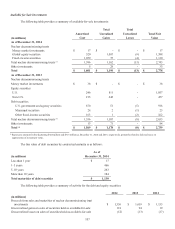

Carryforwards

As of December 31, 2014, PG&E Corporation had approximately $4.1 billion of federal net operating loss carryforwards

and $77 million of tax credit carryforwards, which will expire between 2029 and 2034. In addition, PG&E Corporation had

approximately $219 million of loss carryforwards related to charitable contributions, which will expire between 2015 and 2019.

PG&E Corporation had $123 million of California net operating loss carryforwards which will expire between 2033 and 2034 and

$30 million of California credit carryforwards, some of which will expire in 2024 and others which will carryforward indefinitely.

PG&E Corporation believes it is more likely than not the tax benefits associated with the federal net operating loss, charitable

contributions, and tax credits can be realized within the carryforward periods, therefore no valuation allowance was recognized as

of December 31, 2014. As of December 31, 2014, PG&E Corporation had approximately $24 million of federal net operating loss

carryforwards related to the tax benefit on employee stock plans that would be recorded in additional paid-in capital when used.

NOTE 9: DERIVATIVES

Use of Derivative Instruments

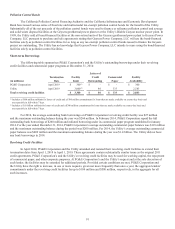

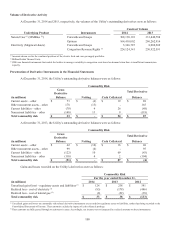

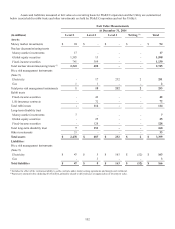

The Utility is exposed to commodity price risk as a result of its electricity and natural gas procurement activities.

Procurement costs are recovered through customer rates. The Utility uses both derivative and non-derivative contracts to manage

volatility in customer rates due to fluctuating commodity prices. Derivatives include forward contracts, swaps, futures, options,

and CRRs.

These instruments are not held for speculative purposes and are subject to certain regulatory requirements. Customer rates

are designed to recover the Utility’s reasonable costs of providing services, including the costs related to price risk management

activities.

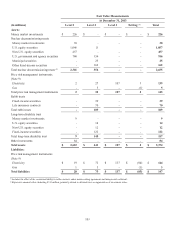

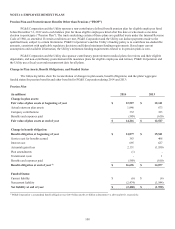

Price risk management activities that meet the definition of derivatives are recorded at fair value on the Consolidated

Balance Sheets. As long as the current ratemaking mechanism discussed in Note 2, above, remains in place and the Utility’s price

risk management activities are carried out in accordance with CPUC directives, the Utility expects to recover fully, in rates, all

costs related to derivatives. Therefore, all unrealized gains and losses associated with the change in fair value of these derivatives

are deferred and recorded within the Utility’s regulatory assets and liabilities on the Consolidated Balance Sheets. Net realized

gains or losses on commodity derivatives are recorded in the cost of electricity or the cost of natural gas with corresponding

increases or decreases to regulatory balancing accounts for recovery from or refund to customers.

Cash collateral paid or received is offset against the fair value of derivative instruments executed with the same

counterparty under a master netting arrangement, where the right of offset and the intention to offset exist. Derivatives are

presented in the Utility’s Consolidated Balance Sheets on a net basis; see below.

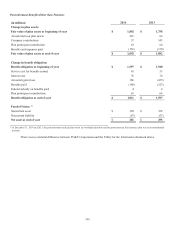

The Utility elects the normal purchase and sale exception for eligible derivatives. Eligible derivatives are those that

require physical delivery in quantities that are expected to be used by the Utility over a reasonable period in the normal course of

business, and do not contain pricing provisions unrelated to the commodity delivered. The fair value of these items is not reflected

in the Consolidated Balance Sheets at fair value, eligible derivatives are accounted for under the accrual method of accounting.