PG&E 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

PG&E Corporation’s and the Utility’s financial results could be materially affected if the Utility is unable to recover a

material portion of its procurement costs and/or if the CPUC fails to adjust the Utility’s rates to reflect the impact of changing loads,

the wide deployment of distributed generation, and the development of new electricity generation and energy storage technologies.

Risks Related to Liquidity and Capital Requirements

PG&E Corporation’s and the Utility’s financial results will be affected by their ability to continue accessing the capital markets

and by the terms of debt and equity financings.

PG&E Corporation’s and the Utility’s ability to access the capital and credit markets and the costs and terms of available

financing depend on many factors, including the ultimate outcome of the matters discussed under “Enforcement and Litigation

Matters” in Item 7. MD&A., the ultimate amount of costs the Utility incurs but does not recover through rates, and the outcome

of pending and future ratemaking proceedings. These outcomes in turn can affect PG&E Corporation’s and the Utility’s credit

ratings and outlook. If PG&E Corporation’s or the Utility’s credit ratings were downgraded to below investment grade, their

ability to access the capital and credit markets would be negatively affected and could result in higher borrowing costs, fewer

financing options, including reduced access to the commercial paper market, additional collateral posting requirements, which in

turn could affect liquidity and lead to an increased financing need. Other factors can affect the availability and terms of debt and

equity financing, including changes in the federal or state regulatory environment affecting energy companies generally or PG&E

Corporation and the Utility in particular, the overall health of the energy industry, volatility in electricity or natural gas prices, and

general economic and financial market conditions.

The reputations of PG&E Corporation and the Utility continue to suffer from the negative publicity about the CPUC

investigations, the criminal investigations, the criminal prosecution, and the other pending enforcement matters. Their negative

reputations and continuing uncertainty surrounding the outcomes of these matters may undermine investors’ confidence in

management’s ability to execute its business strategy and restore a constructive regulatory environment. As a result, investors may

be less willing to buy shares of PG&E Corporation common stock resulting in a lower stock price. Further, the market price of

PG&E Corporation common stock could decline materially after the outcomes are determined. The amount and timing of future

share issuances also could affect the stock price. Declines in the stock price would increase the dilutive effect of future stock

issuances and make it more difficult or expensive for PG&E Corporation to complete future equity offerings.

If the Utility were unable to access the capital markets, it could be required to decrease or suspend dividends to

PG&E Corporation and PG&E Corporation could be required to contribute capital to the Utility to enable the Utility to fulfill

its obligation to serve. To maintain PG&E Corporation’s dividend level in these circumstances, PG&E Corporation would be

further required to access the capital or credit markets. PG&E Corporation may need to decrease or discontinue its common stock

dividend if it is unable to access the capital or credit markets on reasonable terms.

PG&E Corporation’s ability to meet its debt service and other financial obligations and to pay dividends on its common stock

depends on the Utility’s earnings and cash flows.

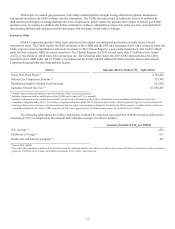

PG&E Corporation is a holding company with no revenue generating operations of its own. The Utility must use its

resources to satisfy its own obligations, including its obligation to serve customers, to pay principal and interest on outstanding

debt, to pay preferred stock dividends, and meet its obligations to employees and creditors, before it can distribute cash to PG&E

Corporation. Under the CPUC’s rules applicable to utility holding companies, the Utility’s dividend policy must be established

by the Utility’s Board of Directors as though the Utility were a stand-alone utility company and PG&E Corporation’s Board of

Directors give “first priority” to the Utility’s capital requirements, as determined to be necessary and prudent to meet the Utility’s

obligation to serve or to operate the Utility in a prudent and efficient manner. The CPUC has interpreted this “first priority”

obligation to include the requirement that PG&E Corporation “infuse the Utility with all types of capital necessary for the Utility

to fulfill its obligation to serve.” In addition, before the Utility can pay common stock dividends to PG&E Corporation, the Utility

must maintain its authorized capital structure with an average 52% equity component.

Depending on the outcome of the CPUC investigations, criminal prosecution, and other enforcement matters pending

against the Utility, future issuances of PG&E Corporation common stock may materially dilute EPS. (See “Liquidity and Financial

Resources” in Item 7. MD&A.) Further, if PG&E Corporation were required to infuse the Utility with significant capital or if the

Utility was unable to distribute cash to PG&E Corporation, or both, PG&E Corporation may be unable to pay principal and interest

on its outstanding debt, pay its common stock dividend or meet other obligations.

PG&E Corporation’s and the Utility’s ability to pay dividends also could be affected by financial covenants contained

in their respective credit agreements that require each company to maintain a ratio of consolidated total debt to consolidated

capitalization of at most 65%.