PG&E 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

Borrowings under the revolving credit facilities (other than swingline loans) bear interest based, at PG&E Corporation’s

and the Utility’s election, on (1) a London Interbank Offered Rate plus an applicable margin or (2) the base rate plus an applicable

margin. The base rate will equal the higher of the following: the administrative agent’s announced base rate, 0.5% above the

federal funds rate, or the one-month LIBOR plus an applicable margin. Interest is payable quarterly in arrears, or earlier for loans

with shorter interest periods. PG&E Corporation and the Utility also will pay a facility fee on the total commitments of the lenders

under the revolving credit facilities. The applicable margins and the facility fees will be based on PG&E Corporation’s and the

Utility’s senior unsecured debt ratings issued by Standard & Poor’s Rating Services and Moody’s Investor Service. Facility fees are

payable quarterly in arrears.

PG&E Corporation’s and the Utility’s revolving credit facilities include usual and customary provisions for revolving

credit facilities of this type, including those regarding events of default and covenants limiting liens to those permitted under

their senior note indentures, mergers, sales of all or substantially all of their assets, and other fundamental changes. In addition,

the revolving credit facilities require that PG&E Corporation and the Utility maintain a ratio of total consolidated debt to total

consolidated capitalization of at most 65% as of the end of each fiscal quarter. PG&E Corporation’s revolving credit facility

agreement also requires that PG&E Corporation own, directly or indirectly, at least 80% of the common stock and at least 70% of

the voting capital stock of the Utility.

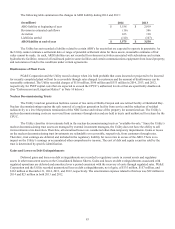

Commercial Paper Programs

For 2014, the average yield on outstanding PG&E Corporation and Utility commercial paper was 0.24% and 0.23%,

respectively.

The borrowings from PG&E Corporation and the Utility’s commercial paper programs are used primarily to fund

temporary financing needs. Liquidity support for these borrowings is provided by available capacity under their respective

revolving credit facilities, as described above. PG&E Corporation and the Utility treat the amount of its outstanding commercial

paper as a reduction to the amount available under its revolving credit facilities. The commercial paper may have maturities up

to 365 days and ranks equally with PG&E Corporation’s and the Utility’s other unsubordinated and unsecured indebtedness.

Commercial paper notes are sold at an interest rate dictated by the market at the time of issuance.

Other Short-term Borrowings

In May 2014, the Utility issued $300 million principal amount of Floating Rate Senior Notes due May 11, 2015.

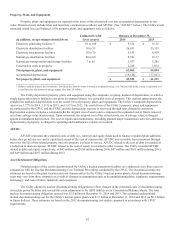

Repayment Schedule

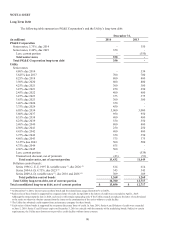

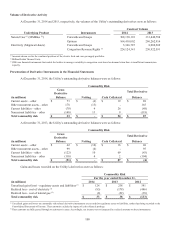

PG&E Corporation’s and the Utility’s combined long-term debt principal repayment amounts at December 31, 2014 are

reflected in the table below:

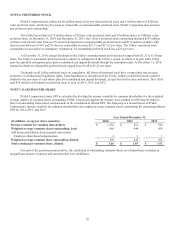

(in millions,

except interest rates) 2015 2016 2017 2018 2019 Thereafter Total

PG&E Corporation

Average xed interest rate - - - - 2.40 % - 2.40 %

Fixed rate obligations $ - $ - $ - $ - $ 350 $ - $ 350

Utility

Average xed interest rate - - 5.63 % 8.25 % - 4.92 % 5.15 %

Fixed rate obligations $ - $ - $ 700 $ 800 $ - $ 12,320 $ 13,820

Variable interest rate

as of December 31, 2014 - 0.01 % - - 0.01 % - 0.01 %

Variable rate obligations (1) $ - $ 160 $ - $ - $ 763 $ - $ 923

Total consolidated debt $ - $ 160 $ 700 $ 800 $ 1,113 $ 12,320 $ 15,093

(1) These bonds, due in 2016 and 2026, are backed by separate letters of credit that expire on December 3, 2016, April 1, 2019, or June 5, 2019.