PG&E 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.117

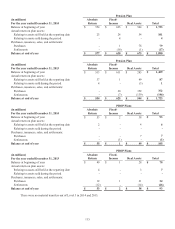

NOTE 12: RESOLUTION OF REMAINING CHAPTER 11 DISPUTED CLAIMS

Various electricity suppliers filed claims in the Utility’s proceeding filed under Chapter 11 of the U.S. Bankruptcy Code

seeking payment for energy supplied to the Utility’s customers between May 2000 and June 2001. These claims, which the Utility

disputes, are being addressed in various FERC and judicial proceedings in which the State of California, the Utility, and other

electricity purchasers are seeking refunds from electricity suppliers, including governmental entities, for overcharges incurred in

the CAISO and the California Power Exchange wholesale electricity markets during this period.

While the FERC and judicial proceedings are pending, the Utility has pursued, and continues to pursue, settlements with

electricity suppliers. The Utility entered into a number of settlement agreements with various electricity suppliers to resolve some

of these disputed claims and to resolve the Utility’s refund claims against these electricity suppliers. These settlement agreements

provide that the amounts payable by the parties are, in some instances, subject to adjustment based on the outcome of the various

refund offset and interest issues being considered by the FERC.

Any net refunds, claim offsets, or other credits that the Utility receives from electricity suppliers through resolution of the

remaining disputed claims, either through settlement or through the conclusion of the various FERC and judicial proceedings, are

refunded to customers through rates in future periods.

Interest accrues on the remaining net disputed claims at the FERC-ordered rate, which is higher than the rate earned

by the Utility on the escrow balance. Although the Utility has been collecting the difference between the accrued interest and

the earned interest from customers in rates, these collections are not held in escrow. If the amount of accrued interest is greater

than the amount of interest ultimately determined to be owed on the remaining net disputed claims, the Utility would refund to

customers any excess interest collected. The amount of any interest that the Utility may be required to pay will depend on the final

determined amount of the remaining net disputed claims and when such interest is paid.

In July 2014, a settlement agreement between the Utility and an electric supplier became effective, resolving a portion of

the Utility’s disputed claims. The settlement will result in refunds to customers of $312 million and will be returned through rates

in future periods. The Utility is uncertain when and how the remaining disputed claims will be resolved.

In August 2014, the Utility received a letter from the California Power Exchange clarifying its ultimate intent to offset the

Utility’s remaining disputed claims principal and interest balances through net settlement. Accordingly, the Utility has presented

$434 million of net Disputed claims and customer refunds on the Consolidated Balance Sheets at December 31, 2014, which

includes both principal and interest. At December 31, 2013, the Consolidated Balance Sheets reflected $154 million of Disputed

claims and customer refunds and $710 million of Interest payable.

At December 31, 2014 and 2013, the Utility held $291 million, respectively, in escrow, including earned interest, for

payment of the remaining net disputed claims liability. These amounts are included within restricted cash on the Consolidated

Balance Sheets.

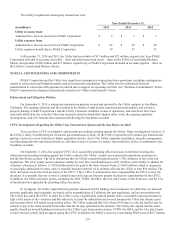

NOTE 13: RELATED PARTY AGREEMENTS AND TRANSACTIONS

The Utility and other subsidiaries provide and receive various services to and from their parent, PG&E Corporation, and

among themselves. The Utility and PG&E Corporation exchange administrative and professional services in support of operations.

Services provided directly to PG&E Corporation by the Utility are priced at the higher of fully loaded cost (i.e., direct cost of

good or service and allocation of overhead costs) or fair market value, depending on the nature of the services. Services provided

directly to the Utility by PG&E Corporation are generally priced at the lower of fully loaded cost or fair market value, depending

on the nature and value of the services. PG&E Corporation also allocates various corporate administrative and general costs to the

Utility and other subsidiaries using agreed-upon allocation factors, including the number of employees, operating and maintenance

expenses, total assets, and other cost allocation methodologies. Management believes that the methods used to allocate expenses

are reasonable and meet the reporting and accounting requirements of its regulatory agencies.