PG&E 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

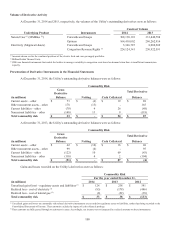

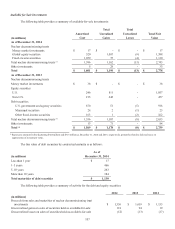

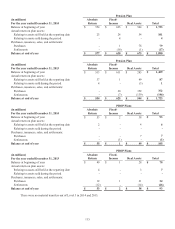

Components of Net Periodic Benefit Cost

Net periodic benefit cost as reflected in PG&E Corporation’s Consolidated Statements of Income was as follows:

Pension Plan

(in millions)2014 2013 2012

Service cost $ 383 $ 468 $ 396

Interest cost 695 627 658

Expected return on plan assets (807) (650) (598)

Amortization of prior service cost 20 20 20

Amortization of net actuarial loss 2111 123

Netperiodicbenetcost 293 576 599

Less: transfer to regulatory account (1) 42 (238) (301)

Total expense recognized $ 335 $ 338 $ 298

(1) The Utility recorded these amounts to a regulatory account as they are probable of recovery from customers in future rates.

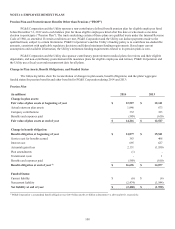

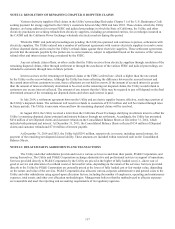

Postretirement Benefits Other than Pensions

(in millions)2014 2013 2012

Service cost $ 45 $ 53 $ 49

Interest cost 76 74 83

Expected return on plan assets (103) (79) (77)

Amortization of transition obligation - - 24

Amortization of prior service cost 23 23 25

Amortization of net actuarial loss 266

Netperiodicbenetcost $ 43 $ 77 $ 110

There was no material difference between PG&E Corporation and the Utility for the information disclosed above.

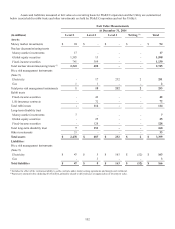

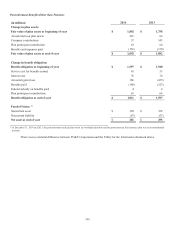

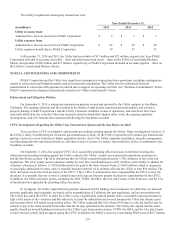

Components of Accumulated Other Comprehensive Income

PG&E Corporation and the Utility record unrecognized prior service costs, unrecognized gains and losses, and

unrecognized net transition obligations related to pension and post-retirement benefits other than pension as components of

accumulated other comprehensive income, net of tax. In addition, regulatory adjustments are recorded in the Consolidated

Statements of Income and Consolidated Balance Sheets to reflect the difference between expense or income calculated in

accordance with GAAP for accounting purposes and expense or income for ratemaking purposes, which is based on authorized

plan contributions. For pension benefits, a regulatory asset or liability is recorded for amounts that would otherwise be recorded

to accumulated other comprehensive income. For post-retirement benefits other than pension, the Utility generally records a

regulatory liability for amounts that would otherwise be recorded to accumulated other comprehensive income. As the Utility is

unable to record a regulatory asset for these other benefits, the charge remains in accumulated other comprehensive income (loss).