PG&E 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

NOTE 5: COMMON STOCK AND SHARE-BASED COMPENSATION

PG&E Corporation had 475,913,404 shares of common stock outstanding at December 31, 2014. PG&E Corporation held

all of the Utility’s outstanding common stock at December 31, 2014.

In February 2014, PG&E Corporation entered into a new equity distribution agreement providing for the sale of PG&E

Corporation common stock having an aggregate gross sales price of up to $500 million. During 2014, PG&E Corporation sold 11

million shares under the February 2014 equity distribution agreement for cash proceeds of $496 million, exhausting the capacity

under this agreement. This amount is net of commissions paid of $4 million.

In addition, PG&E Corporation issued common stock under the PG&E Corporation 401(k) plan, the Dividend

Reinvestment and Stock Purchase Plan, and share-based compensation plans. During 2014, 8 million shares were issued for cash

proceeds of $306 million under these plans.

Dividends

The Board of Directors of PG&E Corporation and the Utility declare dividends quarterly. Under the Utility’s Articles of

Incorporation, the Utility cannot pay common stock dividends unless all cumulative preferred dividends on the Utility’s preferred

stock have been paid. For 2014, the Board of Directors of PG&E Corporation declared a quarterly common stock dividend of

$0.455 per share.

Under their respective credit agreements, PG&E Corporation and the Utility are each required to maintain a ratio of

consolidated total debt to consolidated capitalization of at most 65%. In addition, the CPUC requires the Utility to maintain a

capital structure composed of at least 52% equity on a weighted average over four years. PG&E Corporation and the Utility are in

compliance with these restrictions. At December 31, 2014, the Utility had restricted net assets of $14.6 billion and was limited to

$153 million of additional common stock dividends it could pay to PG&E Corporation at December 31, 2014.

Long-Term Incentive Plan

The PG&E Corporation LTIP permits various forms of share-based incentive awards, including restricted stock awards,

restricted stock units, performance shares, and other share-based awards, to eligible employees of PG&E Corporation and its

subsidiaries. Non-employee directors of PG&E Corporation are also eligible to receive certain share-based awards. In May 2014,

the 2006 LTIP was terminated and the 2014 LTIP became effective. A maximum of 17 million shares of PG&E Corporation

common stock (subject to certain adjustments) has been reserved for issuance under the 2014 LTIP, of which 16,184,126 shares

were available for future awards at December 31, 2014.

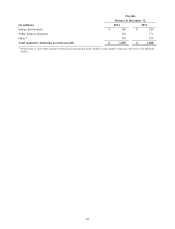

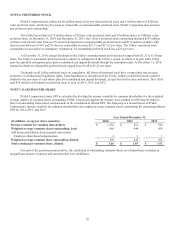

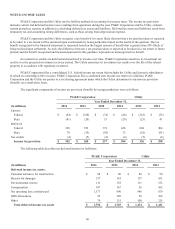

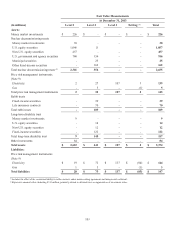

The following table provides a summary of total share-based compensation expense recognized by PG&E Corporation for

share-based incentive awards for 2014, 2013, and 2012:

(in millions)2014 2013 2012

Restricted stock units $ 42 $ 36 $ 31

Performance shares 36 28 26

Total compensation expense (pre-tax) $ 78 $ 64 $ 57

Total compensation expense (after-tax) $ 47 $ 38 $ 34