PG&E 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

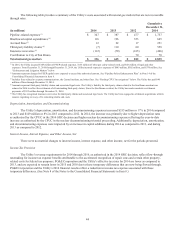

The contractual commitments table above excludes potential payments associated with unrecognized tax positions. Due

to the uncertainty surrounding tax audits, PG&E Corporation and the Utility cannot make reliable estimates of the amounts and

periods of future payments to major tax jurisdictions related to unrecognized tax benefits. Matters relating to tax years that remain

subject to examination are discussed in Note 8 of the Notes to the Consolidated Financial Statements in Item 8.

Off-Balance Sheet Arrangements

PG&E Corporation and the Utility do not have any off-balance sheet arrangements that have had, or are reasonably

likely to have, a current or future material effect on their financial condition, changes in financial condition, revenues or expenses,

results of operations, liquidity, capital expenditures, or capital resources, other than those discussed in Note 14 of the Notes to the

Consolidated Financial Statements (the Utility’s commodity purchase agreements) in Item 8.

ENFORCEMENT AND LITIGATION MATTERS

Since the San Bruno accident occurred on September 9, 2010, PG&E Corporation and the Utility have incurred total

cumulative charges of approximately $2.8 billion related to natural gas matters that are not recoverable through rates. See “Results

of Operations” above.

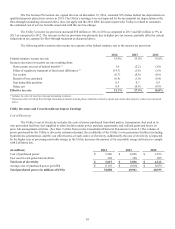

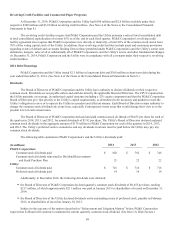

Pending CPUC Investigations

On September 2, 2014, the assigned CPUC ALJs issued their presiding officer decisions in the three investigative

enforcement proceedings pending against the Utility related to the Utility’s natural gas transmission operations and practices

and the San Bruno accident. The ALJs determined that the Utility committed approximately 3,700 violations of law, rules and

regulations. The ALJs jointly issued a decision calling for total fines and disallowances of $1.4 billion on the Utility to address

all violations, allocated as shown in the table below. The ALJs’ decisions are not the final decisions of the CPUC. Three CPUC

Commissioners have requested that the CPUC review the decisions. It is possible that one or more Commissioners will issue an

alternate penalty decision for consideration by the CPUC. In addition, the Utility and other parties, including the SED, TURN,

the ORA, the City and County of San Francisco, and the City of San Bruno have appealed the presiding officer decisions. (For

additional information, see Note 14 of the Notes to the Consolidated Financial Statements in Item 8.) It is uncertain when the final

outcome of the investigations will be determined.

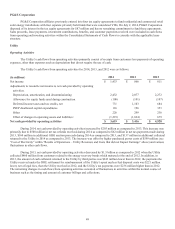

While the various appeals and requests for review of the presiding officer decisions are unresolved there continues to

be significant uncertainty about the ultimate forms and amounts of penalties (including fines) that will be imposed on the Utility.

At December 31, 2014, the Consolidated Balance Sheets included an accrual of $200 million in other current liabilities for

the minimum amount of fines deemed probable. The impact on PG&E Corporation’s and the Utility’s Consolidated Financial

Statements will depend on the amounts and forms of penalties that are ultimately adopted by the CPUC. Fines payable to the

State General Fund or refunds of revenues would be charged to net income when it is probable that such fines or refunds will be

imposed and the amounts can be reasonably estimated. A disallowance of previously authorized and incurred capital costs would

be charged to net income when the disallowance is probable and the amount can be reasonably estimated. Penalties in the form of

future disallowed costs would be charged to net income in the period during which the actual costs are incurred. Although PG&E

Corporation and the Utility believe it is probable that the CPUC will impose total penalties materially in excess of the $200 million

previously accrued, they are unable to make a better estimate due to the variety of potential combinations of amounts and forms

of penalties that could ultimately be imposed on the Utility and uncertainty about the timing of recognition. PG&E Corporation

and the Utility believe the final outcome of the investigations will have a material impact on their financial condition, results of

operations, and cash flows.