PG&E 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

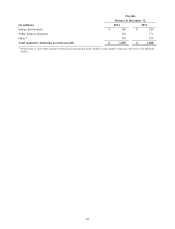

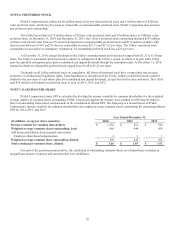

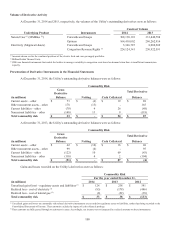

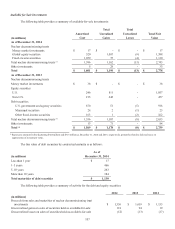

Deferred income tax liabilities:

Regulatory balancing accounts $ 512 $ 261 $ 512 $ 261

Property related basis differences 8,683 8,048 8,666 8,038

Income tax regulatory asset (1) 974 748 974 748

Other 88 151 86 86

Total deferred income tax liabilities $ 10,257 $ 9,208 $ 10,238 $ 9,133

Total net deferred income tax liabilities $ 8,507 $ 7,505 $ 8,764 $ 7,722

Classicationofnetdeferredincometaxliabilities:

Included in current liabilities (assets) $ (6) $ (318) $ (9) $ (320)

Included in noncurrent liabilities 8,513 7,823 8,773 8,042

Total net deferred income tax liabilities $ 8,507 $ 7,505 $ 8,764 $ 7,722

(1) Represents the deferred income tax component of the cumulative differences between amounts recognized for ratemaking purposes and amounts recognized in

accordance with GAAP. (See Note 3 above.)

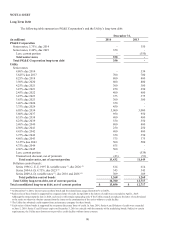

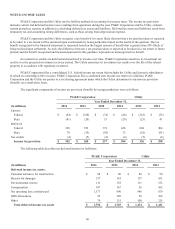

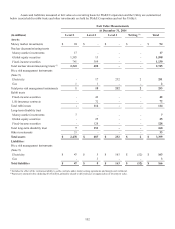

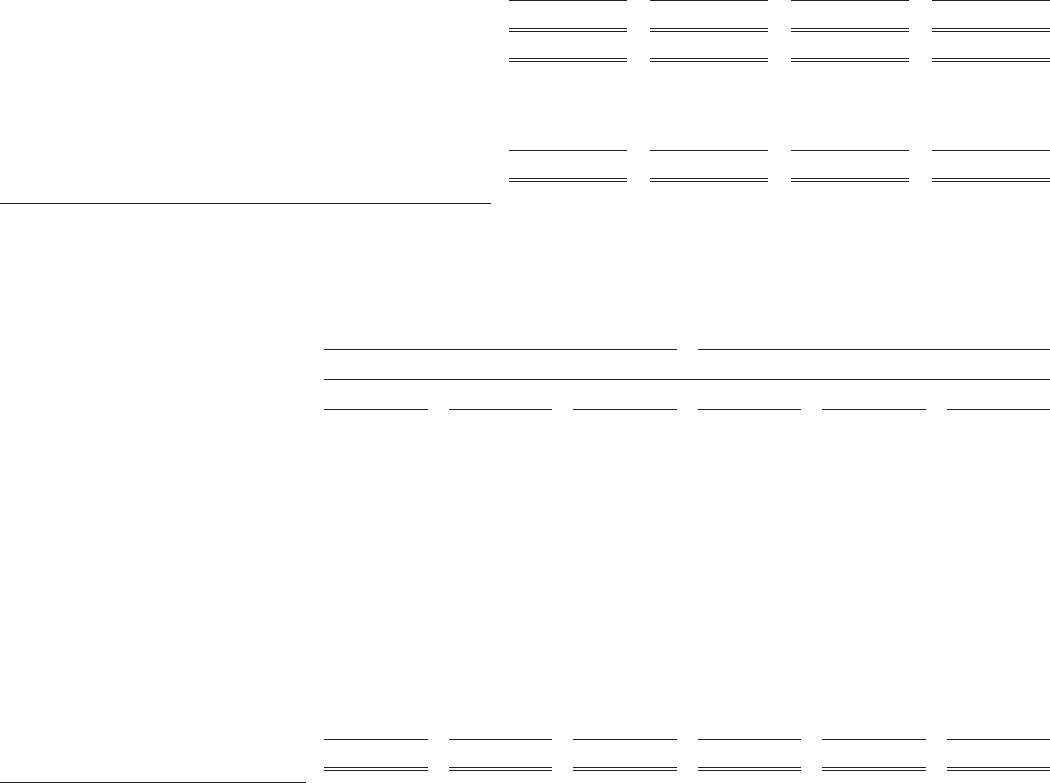

The following table reconciles income tax expense at the federal statutory rate to the income tax provision:

PG&E Corporation Utility

Year Ended December 31,

2014 2013 2012 2014 2013 2012

Federal statutory income tax rate 35.0% 35.0% 35.0% 35.0% 35.0% 35.0%

Increase (decrease) in income

tax rate resulting from:

State income tax (net of

federal benet) (1) 1.4 (3.1) (3.9) 1.6 (2.2) (3.0)

Effect of regulatory treatment

of xed asset differences (2) (15.0) (4.2) (4.1) (14.7) (3.8) (3.9)

Tax credits (0.7) (0.4) (0.6) (0.7) (0.4) (0.6)

Benet of loss carryback (0.8) (1.1) (0.7) (0.8) (1.0) (0.4)

Non deductible penalties 0.3 0.8 0.6 0.3 0.7 0.5

Other, net (0.8) (2.2) (3.8) 0.4 (0.9) (0.8)

Effective tax rate 19.4% 24.8% 22.5% 21.1% 27.4% 26.8%

(1) Includes the effect of state flow-through ratemaking treatment.

(2) Represents effect of federal flow-through ratemaking treatment including those deductions related to repairs and certain other property-related costs discussed

below in the “2014 GRC Impact” section.