PG&E 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

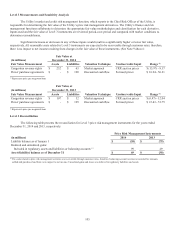

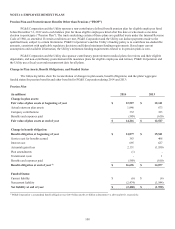

Level 3 Measurements and Sensitivity Analysis

The Utility’s market and credit risk management function, which reports to the Chief Risk Officer of the Utility, is

responsible for determining the fair value of the Utility’s price risk management derivatives. The Utility’s finance and risk

management functions collaborate to determine the appropriate fair value methodologies and classification for each derivative.

Inputs used and the fair value of Level 3 instruments are reviewed period-over-period and compared with market conditions to

determine reasonableness.

Significant increases or decreases in any of those inputs would result in a significantly higher or lower fair value,

respectively. All reasonable costs related to Level 3 instruments are expected to be recoverable through customer rates; therefore,

there is no impact to net income resulting from changes in the fair value of these instruments. (See Note 9 above.)

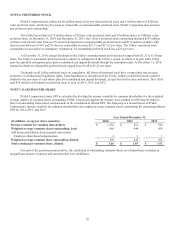

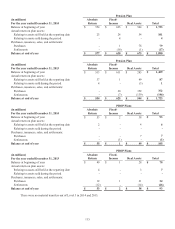

Fair Value at

(in millions) December 31, 2014

Fair Value Measurement Assets Liabilities Valuation Technique Unobservable Input Range (1)

Congestion revenue rights $ 232 $ 63 Market approach CRR auction prices $ (15.97) - 8.17

Power purchase agreements $ - $ 100 Discounted cash ow Forward prices $ 16.04 - 56.21

(1) Represents price per megawatt-hour

Fair Value at

(in millions) December 31, 2013

Fair Value Measurement Assets Liabilities Valuation Technique Unobservable Input Range (1)

Congestion revenue rights $ 107 $ 32 Market approach CRR auction prices $ (6.47) - 12.04

Power purchase agreements $ - $ 105 Discounted cash ow Forward prices $ 23.43 - 51.75

(1) Represents price per megawatt-hour

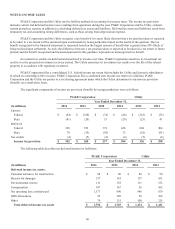

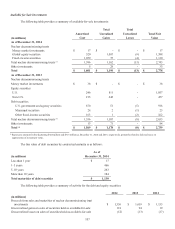

Level 3 Reconciliation

The following table presents the reconciliation for Level 3 price risk management instruments for the years ended

December 31, 2014 and 2013, respectively:

Price Risk Management Instruments

(in millions) 2014 2013

Liability balance as of January 1 $ (30) $ (79)

Realized and unrealized gains:

Included in regulatory assets and liabilities or balancing accounts (1) 99 49

Asset (liability) balance as of December 31 $ 69 $ (30)

(1) The costs related to price risk management activities are recoverable through customer rates, therefore, balancing account revenue is recorded for amounts

settled and purchased and there is no impact to net income. Unrealized gains and losses are deferred in regulatory liabilities and assets.