PG&E 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

OVERVIEW

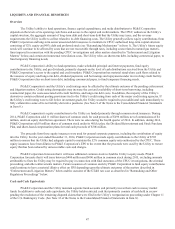

Pacific Gas and Electric Company generates revenues mainly through the sale and delivery of electricity and natural gas to

customers. PG&E Corporation is the parent holding company of the Utility. The authorized revenue requirements set by the CPUC

in the GRC and GT&S rate cases and by the FERC in TO rate cases provide the Utility an opportunity to earn its authorized rates of

return on its “rate base” – the Utility’s net investment in facilities, equipment, and other property used or useful in providing utility

service to its customers. Other than its electric transmission and certain GT&S revenues, the Utility’s decoupling of base revenues

and sales volume eliminates volatility in the revenues earned by the Utility due to fluctuations in customer demand.

The Utility’s revenue requirements are set based on forecast costs. Differences between forecast costs and actual costs can

occur for numerous reasons, including the volume of new customer connections, the detection and mitigation of emerging safety

threats, and the impact of market forces on the cost of labor and materials. Differences in costs can also arise from changes in

laws and regulations at both the state and federal level. Generally, differences between actual costs and forecast costs could affect

the Utility’s ability to earn its authorized return (referred to as “Utility Revenues and Costs that Impacted Earnings” in Results

of Operations below). However, for certain operating costs, such as costs associated with pension and other employee benefits,

the Utility is authorized to track the difference between actual amounts and forecast amounts and recover or refund the difference

through rates (referred to as “Utility Revenues and Costs that did not Impact Earnings” in Results of Operations below). The

Utility also collects additional revenue requirements to recover certain costs that the CPUC has authorized the Utility to pass on to

customers. Therefore, although these costs can fluctuate, they generally do not impact net income (referred to as “Utility Revenues

and Costs that did not Impact Earnings” in Results of Operations below). See “Ratemaking Mechanisms” in Item 1 for further

discussion.

There may be some types of costs that the CPUC has determined will not be recoverable through rates or for which the

Utility does not seek recovery, such as certain pipeline-related costs and fines associated with the Utility’s natural gas transmission

system. The CPUC could also disallow recovery of costs that it finds were not prudently or reasonably incurred. The timing and

amount of the unrecoverable or disallowed costs can materially impact the Utility’s net income, as described more fully below.

This is a combined report of PG&E Corporation and the Utility, and includes separate Consolidated Financial Statements

for each of these two entities. This combined MD&A should be read in conjunction with the Consolidated Financial Statements

and the Notes to the Consolidated Financial Statements included in Item 8.