PG&E 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

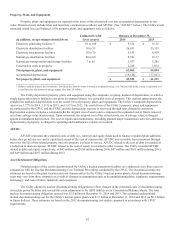

The following table summarizes the changes in ARO liability during 2014 and 2013:

(in millions)2014 2013

ARO liability at beginning of year $ 3,538 $ 2,919

Revision in estimated cash ows (16) 596

Accretion 163 130

Liabilities settled (110) (107)

ARO liability at end of year $ 3,575 $ 3,538

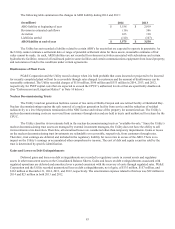

The Utility has not recorded a liability related to certain ARO’s for assets that are expected to operate in perpetuity. As

the Utility cannot estimate a settlement date or range of potential settlement dates for these assets, reasonable estimates of fair

value cannot be made. As such, ARO liabilities are not recorded for retirement activities associated with substations and certain

hydroelectric facilities; removal of lead-based paint in some facilities and certain communications equipment from leased property;

and restoration or land to the conditions under certain agreements.

Disallowance of Plant Costs

PG&E Corporation and the Utility record a charge when it is both probable that costs incurred or projected to be incurred

for recently completed plant will not be recoverable through rates charged to customers and the amount of disallowance can be

reasonably estimated. The Utility recorded charges of $116 million, $196 million and $353 million in 2014, 2013, and 2012,

respectively, for PSEP capital costs that are expected to exceed the CPUC’s authorized levels or that are specifically disallowed.

(See “Enforcement and Litigation Matters” in Note 14 below.)

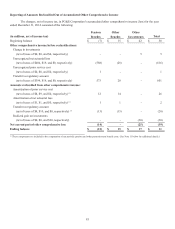

Nuclear Decommissioning Trusts

The Utility’s nuclear generation facilities consist of two units at Diablo Canyon and one retired facility at Humboldt Bay.

Nuclear decommissioning requires the safe removal of a nuclear generation facility from service and the reduction of residual

radioactivity to a level that permits termination of the NRC license and release of the property for unrestricted use. The Utility’s

nuclear decommissioning costs are recovered from customers through rates and are held in trusts until authorized for release by the

CPUC.

The Utility classifies its investments held in the nuclear decommissioning trusts as “available-for-sale.” Since the Utility’s

nuclear decommissioning trust assets are managed by external investment managers, the Utility does not have the ability to sell

its investments at its discretion. Therefore, all unrealized losses are considered other-than-temporary impairments. Gains or losses

on the nuclear decommissioning trust investments are refundable or recoverable, respectively, from customers through rates.

Therefore, trust earnings are deferred and included in the regulatory liability for recoveries in excess of the ARO. There is no

impact on the Utility’s earnings or accumulated other comprehensive income. The cost of debt and equity securities sold by the

trust is determined by specific identification.

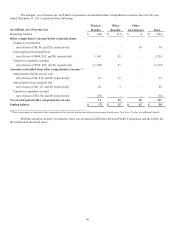

Gains and Losses on Debt Extinguishments

Deferred gains and losses on debt extinguishments are recorded to regulatory assets in current assets and regulatory

assets in other noncurrent assets on the Consolidated Balance Sheets. Gains and losses on debt extinguishments associated with

regulated operations are deferred and amortized over a period consistent with the recovery of costs through regulated rates. PG&E

Corporation and the Utility recorded unamortized loss on debt extinguishments, net of gain, of $135 million, $157 million, and

$163 million at December 31, 2014, 2013, and 2012, respectively. The amortization expense related to this loss was $22 million in

2014 and $23 million in both 2013 and 2012.