PG&E 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

Corporation Board of Directors (and the 2014 Board regarding the allegations first raised in plaintiffs’ 2014 amended consolidated

complaint). The Court has invited plaintiffs to amend their complaint to accommodate this clarification, and defendants to refile a

demurrer on this amended complaint if they so choose. Accordingly, briefing and litigation on this motion is expected to continue

through the first quarter of 2015. On September 22, 2014, PG&E Corporation, the Utility, and the individual defendants filed a

petition with the California Court of Appeal requesting a new order continuing the stay until resolution of the federal criminal

indictment discussed above. A fifth purported shareholder derivative lawsuit that was filed in the U.S. District Court for the

Northern District of California remains stayed.

PG&E Corporation and the Utility are uncertain when and how the above lawsuits will be resolved.

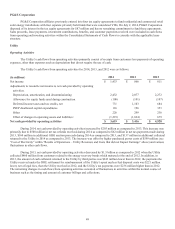

RATEMAKING AND OTHER REGULATORY PROCEEDINGS

The Utility is subject to substantial regulation by the CPUC, the FERC, the NRC and other federal and state regulatory

agencies. The resolutions of these and other proceedings may affect PG&E Corporation’s and the Utility’s financial condition,

results of operations, and cash flows.

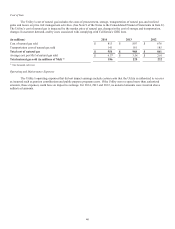

2015 Gas Transmission and Storage Rate Case

Utility’s GT&S Request

In its December 2013 GT&S rate case application, the Utility requested that the CPUC authorize a 2015 revenue

requirement of $1.29 billion to recover anticipated costs of providing natural gas transmission and storage services, an increase

of $555 million over currently authorized amounts. The Utility also requested attrition increases of $61 million in 2016 and

$168 million in 2017 based on its forecasted capital expenditures and the associated growth in rate base, as well as increasing

costs of labor, materials, and other expenses. The Utility requested that the CPUC authorize the Utility’s forecast of its 2015

weighted average rate base for its gas transmission and storage business of $3.56 billion, which includes the capital spend above

authorized levels for the prior rate case period. The Utility has not requested authorization to recover approximately $150 million

of costs it forecasts it will incur over the three-year period to pressure test pipelines placed into service after 1961 that lack records

and perform remedial work associated with the Utility’s pipeline corrosion control program. The Utility also has not requested

authorization to recover costs it forecasts it will incur during 2015 through 2017 to identify and remove encroachments from its gas

transmission pipeline rights-of-way.

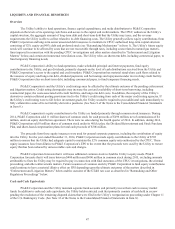

The Utility also has proposed changes to the revenue sharing mechanism authorized in the last GT&S rate case (covering

2011-2014) that subjected a portion of the Utility’s transportation and storage revenue requirement to market risk. The Utility

proposed full balancing account treatment that allows for recovery of the Utility’s authorized transportation and storage revenue

requirements except for the revenue requirement associated with the Utility’s 25% interest in the Gill Ranch storage field.

Intervenors’ Recommendations

The ORA has recommended a 2015 revenue requirement of $1,044 million, an increase of $329 million over authorized

amounts, and attrition increases of $39 million for 2016 and $61 million for 2017. The ORA also recommended that the GT&S

rate case period be expanded to four years with an attrition increase of $35 million for 2018. The ORA proposed that the CPUC

authorize 2015 capital expenditures of $595 million, compared to the Utility’s request of $779 million. TURN has stated that it

intends to make its revenue requirement recommendation in its opening brief to be filed after hearings conclude on February 27,

2015. Nevertheless, TURN has submitted testimony recommending that the Utility not recover costs associated with hydrostatic

testing for pipeline segments placed in service between January 1, 1956 and June 30, 1961, as well as certain other work that

TURN considers to be remedial. TURN also recommended the disallowance of about $200 million of capital expenditures

incurred over the period 2011 through 2014 and recommended that about $500 million of these capital expenditures be subject to

a reasonableness review and an independent audit. TURN states that the Utility’s cost recovery should not begin until the CPUC

issues a decision on the independent audit.

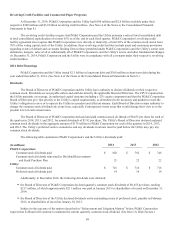

Procedural Schedule

Hearings began on February 2, 2015 and are scheduled to end on February 27, 2015. The current procedural schedule

calls for a final decision to be issued in August 2015. The CPUC has stated that if a final CPUC decision is issued in the three

investigative enforcement proceedings pending against the Utility within the schedule of the 2015 GT&S rate case, the schedule

and scope of issues to be considered may be further amended to consider the implications of that decision on the Utility’s revenue

requirements.