PG&E 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

discount rate, the average rate of future compensation increases, the health care cost trend rate and the expected return on plan

assets. PG&E Corporation and the Utility review these assumptions on an annual basis and adjust them as necessary. While PG&E

Corporation and the Utility believe that the assumptions used are appropriate, significant differences in actual experience, plan

changes or amendments, or significant changes in assumptions may materially affect the recorded pension and other postretirement

benefit obligations and future plan expenses. During 2014, PG&E Corporation and the Utility adopted the Society of Actuaries

2014 Mortality Tables Report (RP-2014) and Mortality Improvement Scale (MP-2014 with modifications), which adjusted the

mortality assumptions used for measuring retirement plan obligations. The updated mortality assumptions reflect increasing life

expectancies in the United States, resulting in an increase to PG&E Corporation’s and the Utility’s pension and PBOP plans’

projected benefit obligations. Future pension and postretirement expenses are also expected to increase due to the new mortality

assumptions.

In establishing health care cost assumptions, PG&E Corporation and the Utility consider recent cost trends and

projections from industry experts. This evaluation suggests that current rates of inflation are expected to continue in the near term.

In recognition of continued high inflation in health care costs and given the design of PG&E Corporation’s plans, the assumed

health care cost trend rate for 2014 is 7.5%, gradually decreasing to the ultimate trend rate of 3.5% in 2024 and beyond.

Expected rates of return on plan assets were developed by estimating future stock and bond returns and then applying

these returns to the target asset allocations of the employee benefit trusts, resulting in a weighted average rate of return on plan

assets. Fixed-income returns were projected based on real maturity and credit spreads added to a long-term inflation rate. Equity

returns were projected based on estimates of dividend yield and real earnings growth added to a long-term rate of inflation. For the

Utility’s defined benefit pension plan, the assumed return of 6.2% compares to a ten-year actual return of 9.3%.

The rate used to discount pension benefits and other benefits was based on a yield curve developed from market data

of approximately 715 Aa-grade non-callable bonds at December 31, 2014. This yield curve has discount rates that vary based on

the duration of the obligations. The estimated future cash flows for the pension and other postretirement benefit obligations were

matched to the corresponding rates on the yield curve to derive a weighted average discount rate.

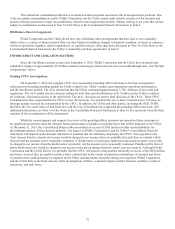

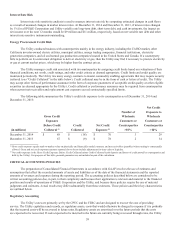

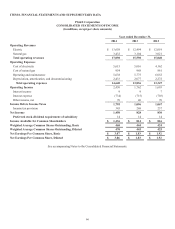

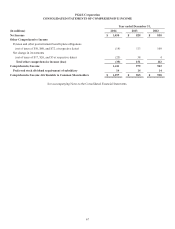

The following reflects the sensitivity of pension costs and projected benefit obligation to changes in certain actuarial

assumptions:

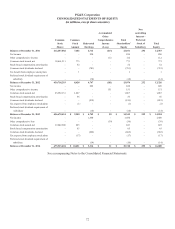

Increase Increase in Projected

(Decrease) in Increase in 2014 Pension BenetObligationat

(in millions) Assumption Costs December 31, 2014

Discount rate (0.50) % $ 52 $1,319

Rate of return on plan assets (0.50) % 62 -

Rate of increase in compensation 0.50 % 32 316

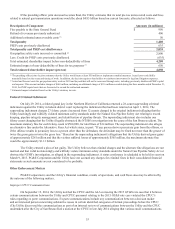

The following reflects the sensitivity of other postretirement benefit costs and accumulated benefit obligation to changes

in certain actuarial assumptions:

Increase Increase in 2014 Increase in Accumulated

(Decrease) in Other Postretirement BenetObligationat

(in millions) Assumption BenetCosts December 31, 2014

Health care cost trend rate 0.50 % $ 4$53

Discount rate (0.50) % 3 128

Rate of return on plan assets (0.50) % 9 -

NEW ACCOUNTING PRONOUNCEMENTS

See Note 2 of the Notes to the Consolidated Financial Statements.