PG&E 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

ITEM 1A. RISK FACTORS

PG&E Corporation’s and the Utility’s financial results are influenced by many factors that are difficult to predict, involve

uncertainties that may materially affect actual results and are often beyond their control. (Also see Cautionary Language Regarding

Forward-Looking Statements in Item 7. MD&A.) In addition to other disclosures within this Form 10-K, including MD&A in

Item 7 and Note 2: Summary of Significant Accounting Policies in the Notes to the Consolidated Financial Statements in Item 8

and other documents filed with the SEC from time to time, the following key risk factors should be considered in evaluating an

investment in PG&E Corporation and the Utility. Such factors could affect actual results of operations and cause results to differ

substantially from historical results or from results that are currently sought.

Risks Related to the Outcome of Enforcement Matters, Investigations, and Regulatory Proceedings

PG&E Corporation’s and the Utility’s financial results could be materially affected by the outcomes of the CPUC investigative

enforcement proceedings pending against the Utility, the federal criminal prosecution of the Utility, and the investigations and

other potential enforcement matters discussed in Item 7. MD&A.

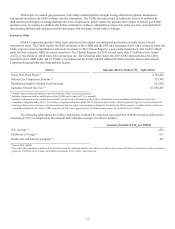

In September 2014, the CPUC ALJs overseeing the three investigative enforcement proceedings against the Utility issued

a decision to impose total penalties of $1.4 billion on the Utility based on their findings that the Utility committed approximately

3,700 violations of natural gas regulations. The Utility and other parties have appealed these decisions. (See “Enforcement and

Litigation Matters – Pending CPUC Investigations” in Item 7. MD&A.) The CPUC could issue a final decision that imposes a

materially higher amount of penalties. The impact on PG&E Corporation’s and the Utility’s consolidated financial statements will

vary depending on the forms and amounts of penalties imposed.

Further, if the Utility is convicted of the pending federal criminal charges, the Utility could be required to pay a material

amount of fines. Based on the superseding indictment’s allegations, the maximum alternative fine would be approximately $1.13 billion.

(See “Enforcement and Litigation Matters – Federal Criminal Indictment” in Item 7. MD&A.) The Utility also could incur a material

amount of costs to comply with remedial measures that the CPUC or a federal judge may impose on the Utility, such as a requirement

that the Utility’s natural gas operations be supervised by a third-party monitor.

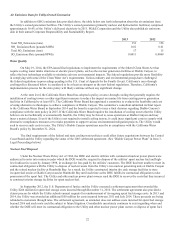

The CPUC could impose penalties or take other enforcement action with respect to communications that may

have violated the CPUC’s rules regarding ex parte communications (See “Enforcement and Litigation Matters – Improper

CPUC Communications” in Item 7. MD&A.) In response to the Utility’s violations of the CPUC’s rules regarding ex parte

communications relating to the 2015 GT&S rate case, the CPUC issued a decision to disallow up to the entire amount of

incremental revenues that would have been collected from ratepayers over the five-month period between March 2015 and August

2015. The exact amount of the revenue disallowance will be determined in the CPUC’s final decision in the 2015 GT&S rate

case. See “Ratemaking and Other Regulatory Proceedings – 2015 Gas Transmission and Storage Rate Case” in Item 7. MD&A.

Federal and state law enforcement authorities have begun investigations in connection with these matters and they could take

enforcement action in the future. The Utility could be subject to additional penalties or reputational harm if it fails to comply with

the restrictions on communications between the Utility and the CPUC imposed by the CPUC in November 2014.

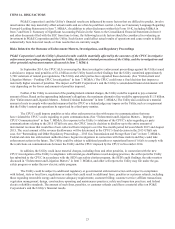

In addition, the Utility could incur material charges, including fines and other penalties, in connection with the new

CPUC investigation of the Utility’s compliance with natural gas distribution record-keeping practices, the self-reports the Utility

has submitted to the CPUC in accordance with the SED’s gas safety citation program, the SED’s audit findings, the other matters

discussed in “Enforcement and Litigation Matters” in Item 7. MD&A, and other self-reports the Utility may file under the gas

safety program or under the new electric safety program.

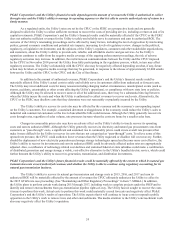

The Utility could be subject to additional regulatory or governmental enforcement action with respect to compliance

with federal, state or local laws, regulations or orders that could result in additional fines, penalties or customer refunds, including

those regarding renewable energy and resource adequacy requirements; customer billing; customer service; affiliate transactions;

vegetation management; design, construction, operating and maintenance practices; safety and inspection practices; and federal

electric reliability standards. The amount of such fines, penalties, or customer refunds could have a material effect on PG&E

Corporation’s and the Utility’s financial results.