PG&E 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

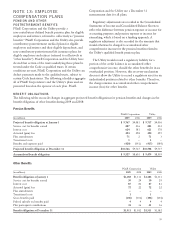

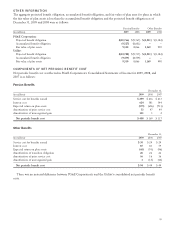

OTHER INFORMATION

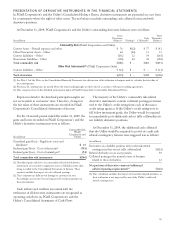

The aggregate projected benefit obligation, accumulated benefit obligation, and fair value of plan asset for plans in which

the fair value of plan assets is less than the accumulated benefit obligation and the projected benefit obligation as of

December 31, 2009 and 2008 were as follows:

Pension Benefits Other Benefits

(in millions) 2009 2008 2009 2008

PG&E Corporation:

Projected benefit obligation $(10,766) $(9,767) $(1,511) $(1,382)

Accumulated benefit obligation (9,527) (8,601) ——

Fair value of plan assets 9,330 8,066 1,169 990

Utility:

Projected benefit obligation $(10,708) $(9,717) $(1,511) $(1,382)

Accumulated benefit obligation (9,479) (8,559) ——

Fair value of plan assets 9,330 8,066 1,169 990

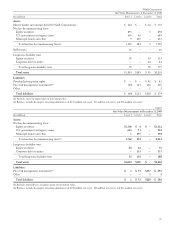

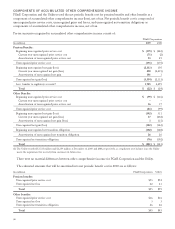

COMPONENTS OF NET PERIODIC BENEFIT COST

Net periodic benefit cost as reflected in PG&E Corporation’s Consolidated Statements of Income for 2009, 2008, and

2007 is as follows:

Pension Benefits

December 31,

(in millions) 2009 2008 2007

Service cost for benefits earned $ 259 $ 236 $ 233

Interest cost 624 581 544

Expected return on plan assets (579) (696) (711)

Amortization of prior service cost 53 47 49

Amortization of unrecognized gain 101 12

Net periodic benefit cost $ 458 $ 169 $ 117

Other Benefits

December 31,

(in millions) 2009 2008 2007

Service cost for benefits earned $30 $29 $29

Interest cost 87 81 79

Expected return on plan assets (68) (93) (96)

Amortization of transition obligation 26 26 26

Amortization of prior service cost 16 16 16

Amortization of unrecognized gain 3(15) (10)

Net periodic benefit cost $94 $44 $44

There was no material difference between PG&E Corporation’s and the Utility’s consolidated net periodic benefit

costs.

95