PG&E 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.revenues. The CPUC adopted a schedule for the final

true-up process that calls for a final decision by the end of

2010. PG&E Corporation and the Utility are unable to

predict the amount, if any, of the $40.3 million holdback

that the Utility may receive after the true-up process is

completed.

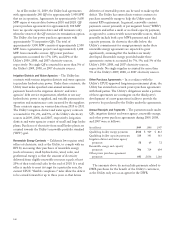

Spent Nuclear Fuel Storage Proceedings

As part of the Nuclear Waste Policy Act of 1982, Congress

authorized the U.S. Department of Energy (“DOE”) and

electric utilities with commercial nuclear power plants to

enter into contracts under which the DOE would be

required to dispose of the utilities’ spent nuclear fuel and

high-level radioactive waste no later than January 31, 1998,

in exchange for fees paid by the utilities. In 1983, the DOE

entered into a contract with the Utility to dispose of

nuclear waste from the Utility’s two nuclear generating

units at Diablo Canyon and its retired nuclear facility at

Humboldt Bay.

Because the DOE failed to develop a permanent storage

site, the Utility obtained a permit from the NRC to build

an on-site dry cask storage facility to store spent fuel

through at least 2024. The construction of the dry cask

storage facility is complete. During 2009 the Utility moved

all the spent nuclear fuel that was scheduled to be moved

into dry cask storage. An appeal of the NRC’s issuance of

the permit is still pending in the U.S. Court of Appeals for

the Ninth Circuit. The appellants claim that the NRC

failed to adequately consider environmental impacts of a

potential terrorist attack at Diablo Canyon. It is uncertain

when the appeal will be addressed by the Ninth Circuit.

As a result of the DOE’s failure to build a repository for

nuclear waste, the Utility and other nuclear power plant

owners sued the DOE to recover costs that they incurred to

build on-site spent nuclear fuel storage facilities. The

Utility seeks to recover $92 million of costs that it incurred

through 2004. After several years of litigation, in 2008 the

U.S. Court of Appeals for the Federal Circuit (“Federal

Circuit”) issued an order clarifying the method to calculate

damages to be awarded to the utilities for breach of their

contracts by the DOE. Although the DOE has conceded

that the Utility is entitled to recover approximately $82

million based on this method, the DOE continues to

challenge the method in related litigation. In October

2009, a trial was held in the U.S. Federal Court of Claims

to determine the amounts owed to the Utility based on the

methodology approved by the Federal Circuit. The parties

are waiting for the court to issue its decision. The Utility

also will seek to recover costs incurred after 2004 to build

on-site storage facilities.

PG&E Corporation and the Utility are unable to predict

the amount and timing of any recoveries that the Utility

will receive from the DOE. Amounts recovered from the

DOE will be credited to customers.

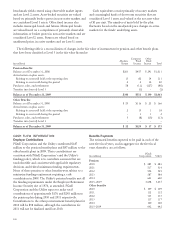

Nuclear Insurance

The Utility has several types of nuclear insurance for the

two nuclear operating units at Diablo Canyon and for its

retired nuclear generation facility at Humboldt Bay Unit 3.

The Utility has insurance coverage for property damages

and business interruption losses as a member of Nuclear

Electric Insurance Limited (“NEIL”). NEIL is a mutual

insurer owned by utilities with nuclear facilities. NEIL

provides property damage and business interruption

coverage of up to $3.24 billion per incident for Diablo

Canyon. In addition, NEIL provides $131 million of

property damage insurance for Humboldt Bay Unit 3.

Under this insurance, if any nuclear generating facility

insured by NEIL suffers a catastrophic loss causing a

prolonged outage, the Utility may be required to pay an

additional premium of up to $39.7 million per one-year

policy term.

NEIL also provides coverage for damages caused by acts

of terrorism at nuclear power plants. Under the Terrorism

Risk Insurance Program Reauthorization Act of 2007

(“TRIPRA”), acts of terrorism may be “certified” by the

Secretary of the Treasury. For a certified act of terrorism,

NEIL can obtain compensation from the federal

government and will provide up to the full policy limits to

the Utility for an insured loss. If one or more non-certified

acts of terrorism cause property damage covered under any

of the nuclear insurance policies issued by NEIL to any

NEIL member, the maximum recovery under all those

nuclear insurance policies may not exceed $3.24 billion

within a 12-month period plus the additional amounts

recovered by NEIL for these losses from reinsurance.

(TRIPRA extends the Terrorism Risk Insurance Act of 2002

through December 31, 2014.)

Under the Price-Anderson Act, public liability claims

from a nuclear incident are limited to $12.5 billion. As

required by the Price-Anderson Act, the Utility purchased

the maximum available public liability insurance of $300

million for Diablo Canyon. The balance of the $12.5

billion of liability protection is covered by a loss-sharing

program among utilities owning nuclear reactors. Under

the Price-Anderson Act, owner participation in this loss-

sharing program is required for all owners of nuclear

reactors that are licensed to operate, designed for the

production of electrical energy, and have a rated capacity

of 100 MW or higher. If a nuclear incident results in costs

in excess of $300 million, then the Utility may be

responsible for up to $117.5 million per reactor, with

109