PG&E 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

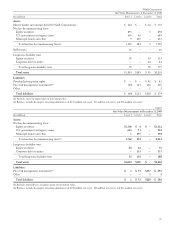

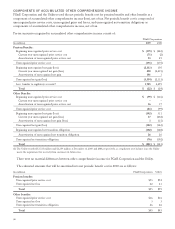

COMPONENTS OF ACCUMULATED OTHER COMPREHENSIVE INCOME

PG&E Corporation and the Utility record the net periodic benefit cost for pension benefits and other benefits as a

component of accumulated other comprehensive income (loss), net of tax. Net periodic benefit cost is composed of

unrecognized prior service costs, unrecognized gains and losses, and unrecognized net transition obligations as

components of accumulated other comprehensive income, net of tax.

Pre-tax amounts recognized in accumulated other comprehensive income consist of:

PG&E Corporation

(in millions) 2009 2008

Pension Benefits:

Beginning unrecognized prior service cost $ (175) $ (222)

Current year unrecognized prior service cost (71) (2)

Amortization of unrecognized prior service cost 53 49

Unrecognized prior service cost (193) (175)

Beginning unrecognized net gain (loss) (2,113) 105

Current year unrecognized net gain (loss) 458 (2,219)

Amortization of unrecognized net gain 101 1

Unrecognized net gain (loss) (1,554) (2,113)

Less: transfer to regulatory account(1) 1,725 2,259

Total $ (22) $ (29)

Other Benefits:

Beginning unrecognized prior service cost $ (99) $ (116)

Current year unrecognized prior service cost ––

Amortization of unrecognized prior service cost 16 17

Unrecognized prior service cost (83) (99)

Beginning unrecognized net gain (loss) (142) 311

Current year unrecognized net gain (loss) 17 (438)

Amortization of unrecognized net gain (loss) 3(15)

Unrecognized net gain (loss) (122) (142)

Beginning unrecognized net transition obligation (102) (128)

Amortization of unrecognized net transition obligation 26 26

Unrecognized net transition obligation (76) (102)

Total $ (281) $ (343)

(1) The Utility recorded $1,725 million and $2,259 million at December 31, 2009 and 2008, respectively, as a regulatory asset balance since the Utility

meets the requirement for recovery from customers in future rates.

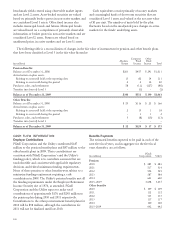

There were no material differences between other comprehensive income for PG&E Corporation and the Utility.

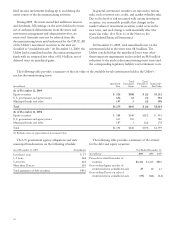

The estimated amounts that will be amortized into net periodic benefit cost in 2010 are as follows:

(in millions) PG&E Corporation Utility

Pension benefits:

Unrecognized prior service cost $53 $54

Unrecognized net loss 42 41

Total $95 $95

Other benefits:

Unrecognized prior service cost $16 $16

Unrecognized net loss 33

Unrecognized net transition obligation 26 26

Total $45 $45

96