PG&E 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

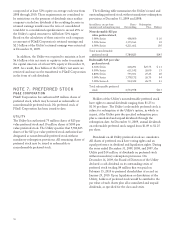

prospectively for PG&E Corporation and the Utility

beginning on January 1, 2010. PG&E Corporation and the

Utility are currently evaluating the impact of ASU

No. 2009-16.

Consolidations (Topic 810) — Improvements to

Financial Reporting by Enterprises Involved with

Variable Interest Entities

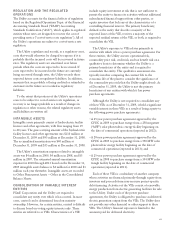

In December 2009, the FASB issued ASU No. 2009-17,

“Consolidations (Topic 810)—Improvements to Financial

Reporting by Enterprises Involved with Variable Interest

Entities” (“ASU No. 2009-17”). ASU No. 2009-17 amends

the Consolidation Topic of the FASB ASC regarding when

and how to determine, or re-determine, whether an entity

is a VIE. In addition, ASU No. 2009-17 replaces the

Consolidation Topic of the FASB ASC’s quantitative

approach for determining who has a controlling financial

interest in a VIE with a qualitative approach. Furthermore,

ASU No. 2009-17 requires ongoing assessments of whether

an entity is the primary beneficiary of a VIE. ASU

No. 2009-17 is effective prospectively for PG&E

Corporation and the Utility beginning on January 1, 2010.

PG&E Corporation and the Utility are currently evaluating

the impact of ASU No. 2009-17.

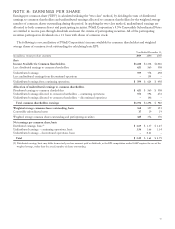

Fair Value Measurements and Disclosures (Topic 820)

— Improving Disclosures about Fair Value

Measurements

In January 2010, the FASB issued ASU No. 2010-06, “Fair

Value Measurements and Disclosures (Topic 820)—

Improving Disclosures about Fair Value Measurements”

(“ASU No. 2010-06”). ASU No. 2010-06 requires

additional disclosures regarding (1) transfers into and out of

Levels 1 and 2 of the fair value hierarchy, and (2) fair value

measurement inputs and techniques. In addition, ASU

No. 2010-06 clarifies that fair value measurement

disclosures and postretirement benefit plan asset

disclosures should be disaggregated beyond the line items

in the balance sheet. These new disclosures and this

clarification are effective prospectively for PG&E

Corporation and the Utility beginning on January 1, 2010.

Furthermore, ASU No. 2010-06 modifies, from a net basis

to a gross basis, the presentation of purchases, sales,

issuances, and settlements in the disclosure of activity in

Level 3 of the fair value hierarchy. This modification is

effective prospectively for PG&E Corporation and the

Utility beginning on January 1, 2011. PG&E Corporation

and the Utility are currently evaluating the impact of ASU

No. 2010-06.

NOTE 3: REGULATORY

ASSETS, LIABILITIES, AND

BALANCING ACCOUNTS

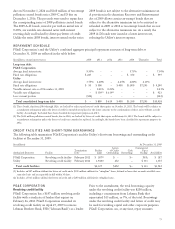

REGULATORY ASSETS

Current Regulatory Assets

At December 31, 2009 and 2008, the Utility had current

regulatory assets of $427 million and $355 million,

respectively, consisting primarily of the current portion of

price risk management regulatory assets. Price risk

management regulatory assets represent the deferral of

unrealized losses related to price risk management

derivative instruments with terms of less than one year.

(See Note 10 of the Notes to the Consolidated Financial

Statements for further discussion.) Current regulatory assets

are included in Prepaid expenses and other in the

Consolidated Balance Sheets.

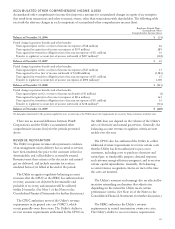

Long-Term Regulatory Assets

Long-term regulatory assets are composed of the following:

Balance at December 31,

(in millions) 2009 2008

Pension benefits $1,386 $1,624

Energy recovery bonds 1,124 1,487

Deferred income tax 1,027 847

Utility retained generation 737 799

Environmental compliance costs 408 385

Price risk management 346 362

Unamortized loss, net of gain, on

reacquired debt 203 225

Other 291 267

Total long-term regulatory assets $5,522 $5,996

The regulatory asset for pension benefits represents the

cumulative differences between amounts recognized for

ratemaking purposes and amounts recognized in

accordance with GAAP, which also includes amounts that

otherwise would be fully recorded to Accumulated other

comprehensive loss in the Consolidated Balance Sheets.

(See Note 13 of the Notes to the Consolidated Financial

Statements for further discussion.)

The regulatory asset for energy recovery bonds (“ERB”)

represents the refinancing of the regulatory asset provided

for in the settlement agreement entered into between

PG&E Corporation, the Utility, and the CPUC in 2003 to

resolve the Utility’s proceeding under Chapter 11

(“Chapter 11 Settlement Agreement”). (See Note 5 of the

Notes to the Consolidated Financial Statements for further

discussion of the ERBs.) The regulatory asset is amortized

over the life of the bonds consistent with the period over

which the related billed revenues and bond-related

67