PG&E 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 13: EMPLOYEE

COMPENSATION PLANS

PENSION AND OTHER

POSTRETIREMENT BENEFITS

PG&E Corporation and the Utility provide a

non-contributory defined benefit pension plan for eligible

employees and retirees, referred to collectively as “pension

benefits.” PG&E Corporation and the Utility also provide

contributory postretirement medical plans for eligible

employees and retirees and their eligible dependents, and

non-contributory postretirement life insurance plans for

eligible employees and retirees (referred to collectively as

“other benefits”). PG&E Corporation and the Utility have

elected that certain of the trusts underlying these plans be

treated under the Code as qualified trusts. If certain

conditions are met, PG&E Corporation and the Utility can

deduct payments made to the qualified trusts, subject to

certain Code limitations. The following schedules aggregate

all of PG&E Corporation’s and the Utility’s plans and are

presented based on the sponsor of each plan. PG&E

Corporation and the Utility use a December 31

measurement date for all plans.

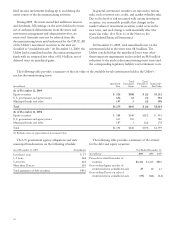

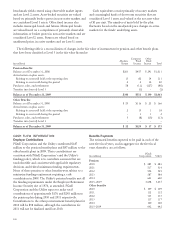

Regulatory adjustments are recorded in the Consolidated

Statements of Income and Consolidated Balance Sheets to

reflect the difference between pension expense or income for

accounting purposes and pension expense or income for

ratemaking, which is based on a funding approach. A

regulatory adjustment is also recorded for the amounts that

would otherwise be charged to accumulated other

comprehensive income for the pension benefits related to

the Utility’s qualified benefit pension plan.

The Utility would record a regulatory liability for a

portion of the credit balance in accumulated other

comprehensive income, should the other benefits be in an

overfunded position. However, this recovery mechanism

does not allow the Utility to record a regulatory asset for an

underfunded position related to other benefits. Therefore,

the charge remains in accumulated other comprehensive

income (loss) for other benefits.

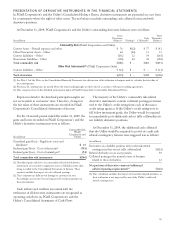

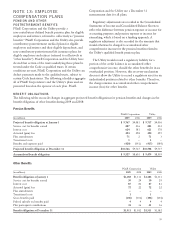

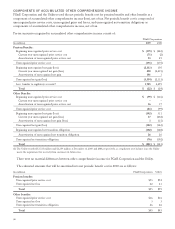

BENEFIT OBLIGATIONS

The following tables reconcile changes in aggregate projected benefit obligations for pension benefits and changes in the

benefit obligation of other benefits during 2009 and 2008:

Pension Benefits

PG&E Corporation Utility

(in millions) 2009 2008 2009 2008

Projected benefit obligation at January 1 $ 9,767 $9,081 $ 9,717 $9,036

Service cost for benefits earned 227 236 223 234

Interest cost 624 581 621 578

Actuarial (gain) loss 494 258 490 255

Plan amendments 71 271 3

Transitional costs 3—3—

Benefits and expenses paid (420) (391) (417) (389)

Projected benefit obligation at December 31 $10,766 $9,767 $10,708 $9,717

Accumulated benefit obligation $ 9,527 $8,601 $ 9,479 $8,559

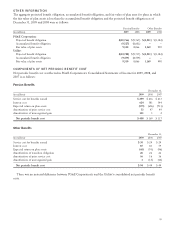

Other Benefits

PG&E Corporation Utility

(in millions) 2009 2008 2009 2008

Benefit obligation at January 1 $1,382 $1,311 $1,382 $1,311

Service cost for benefits earned 30 29 30 29

Interest cost 87 81 87 81

Actuarial (gain) loss 72 22 72 22

Plan amendments ————

Transitional costs 11

Gross benefits paid (106) (101) (106) (101)

Federal subsidy on benefits paid 4444

Plan participant contributions 41 36 41 36

Benefit obligation at December 31 $1,511 $1,382 $1,511 $1,382

93